Florida Debt Relief: 5-Year Trends

The average Floridian carried $59,800 in non-mortgage household debt in 2024, which was roughly 3% below the national average of $61,700. Mortgage debt made up just under 67% of total household debt, followed by credit cards, student loans, and auto loans. The Florida county with the highest debt load was Santa Rosa, where residents owed $5.50 for every $1 of income. No matter where in Florida a consumer resides, it’s critical to have access to strategies for dealing with debt, including debt relief.

In 2007, just as the Great Recession was setting in and debt was at its peak, Florida residents owed around $6,700 more than the average American. By 2024, they owed approximately $1,900 less, indicating that the situation had turned around for some of them.

Floridians can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

5-Year Debt Trends in Florida

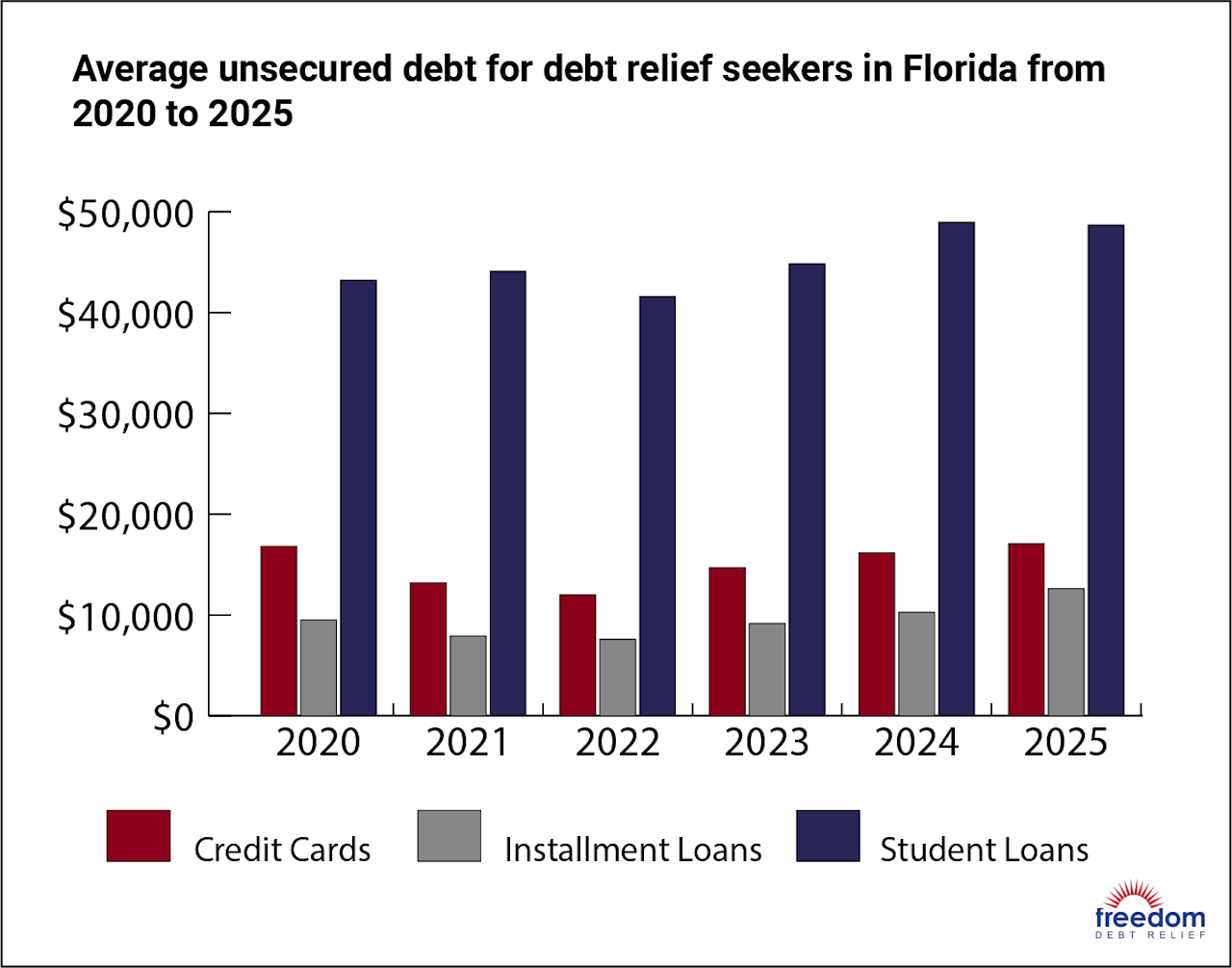

Consumer debt in Florida has risen 11% over the last five years. Among debt relief seekers, unsecured debt went from an average of $69,559 in 2020 to $78,375 in 2025. Over the same period, average unsecured debt in the U.S. grew by 12% (among debt relief seekers), slightly higher than Florida’s average. Unsecured debt is any debt that isn’t tied to collateral, and includes balances on credit cards, personal loans, and student loans.

Typical debt balances are frequently tied to age and credit scores. For Florida residents seeking debt relief, unsecured debt peaks among the 51-65 age bracket, at an average level of $87,389 in 2025. Debt relief seekers with good credit (scores ranging from 670-739) have the highest unsecured debt balances in 2025, averaging $92,504. Those with good credit had the highest balances in 2022 and 2024: $80,362 and $85,797, respectively.

Accounts in collections in Florida have dropped significantly since 2020, when they hit 3.1. In 2025, they’re down to an average of 1.8 per debt relief seeker. That’s in keeping with debt relief seekers nationwide.

During the same five-year period, average collection balances have also dropped (except in 2021, when balances peaked). While they were $3,815 in 2020, collection balances have decreased by $775 to $3,040 in 2025.

Florida credit card debt

Despite a lower collection rate in the state, the average credit card debt of Floridians seeking debt relief options is $17,069, a little higher than the $16,244 average balance held by debt relief seekers nationwide. Debt was spread across an average of 7.6 cards, with an average past-due balance of $6,284.

The average monthly credit card payment is $494. While this relatively low payment may sound like a break for consumers, low payments extend the time Floridians must pay high interest rates. Low payments make it harder to get out of debt.

Credit utilization is your credit card balance compared to your credit limit. Lower is better. The average credit utilization among those seeking relief is 73.1%, approximately the same as debt seekers nationwide.

In 2025, Florida consumers aged 51-65 have the highest credit card debt, averaging $18,087. They’re followed closely by those 65 and older, who carry an average of $18,058.

Florida auto loan debt

Debt relief seekers in Florida in 2025 have an average car payment of $755 and an average auto loan balance of $27,709. Both amounts have risen since 2020, when the average payment was $581, and the average balance was $22,075.

Florida mortgage debt

On average, debt relief seekers in Florida have a monthly mortgage payment of $2,155 and an average balance of $252,642. This is a bit higher than the $1,989 average payment and $239,406 average balance held by debt seekers nationwide.

Home buyers across the country have experienced a dramatic increase in home prices since the COVID-19 pandemic. In 2020, those seeking debt relief carried mortgages with an average balance of $198,445. In 2025, that balance is roughly 22% higher.

Florida installment loan debt

Installment loans are repaid over time with a set number of scheduled payments. The average Florida debt relief seeker has $12,610 in non-mortgage installment loan debt in 2025, nearly identical to the balance held by debt relief seekers nationwide ($12,632). The average installment loan payment in Florida is $478.

One concerning trend is the steady growth in installment loan balances. While they dropped in 2021 and 2022 to $7,927 and $7,594, respectively (likely thanks to federal stimulus checks sent during the pandemic), they’ve crept up since that time.

Florida student loan debt

Student loan debt is a burden for millions of Americans, and Floridians are no exception. The average balance among those seeking debt relief help is $48,696. The average payment on this debt is $296, up from $225 in 2020.

As with installment loans, student loan debt is rising, from an average of $43,224 in 2020 to $48,696 today.

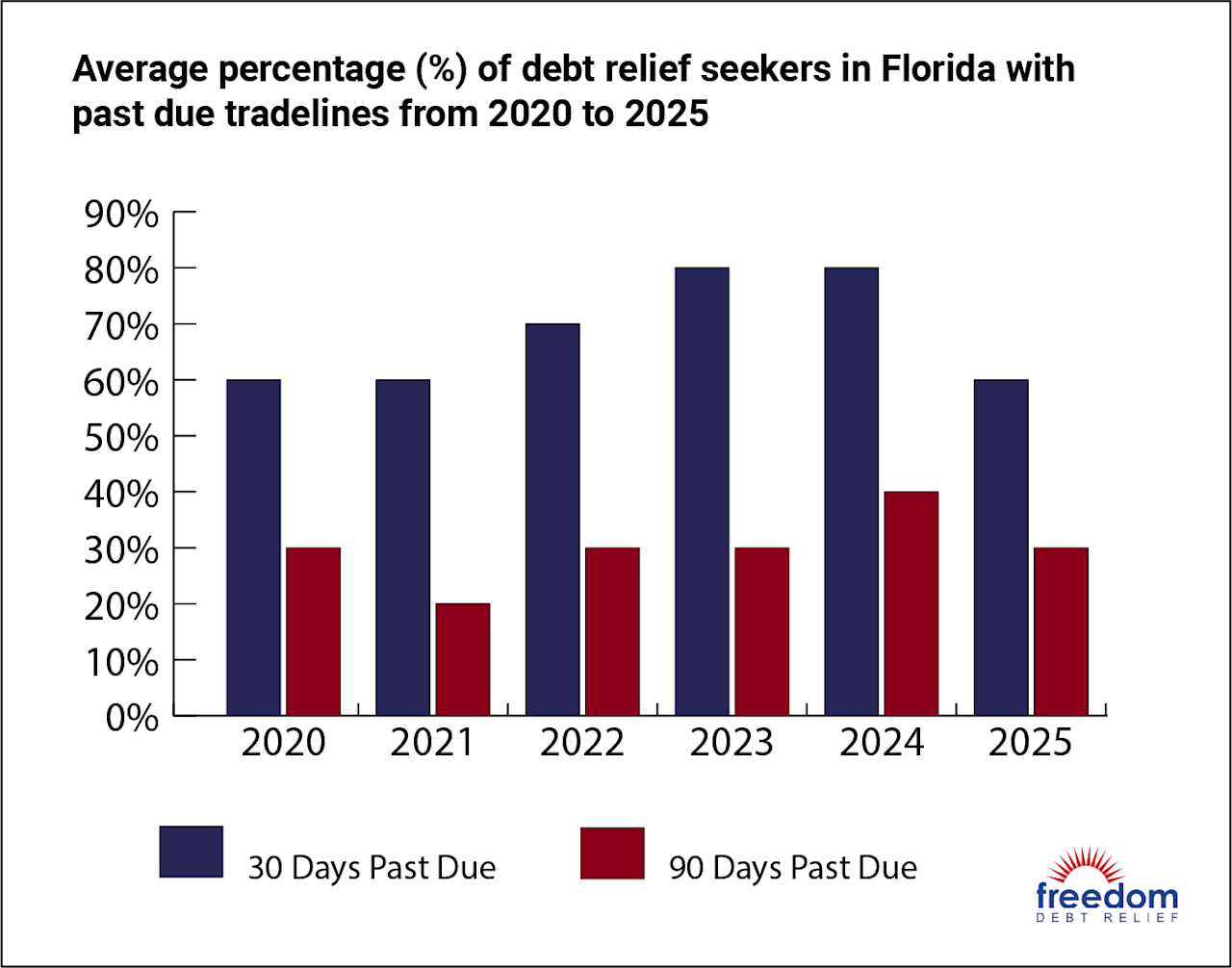

Florida Debt Delinquencies and Collections

While credit card and mortgage delinquency rates are lower for Floridians than the national average, some struggle with their auto loans. In Florida, 4.68% of auto loans are at least 30 days past due (DPD), compared with 4.34% nationwide.

The table below shows delinquency rates for Florida auto loans, credit cards, and mortgages, with delinquency percentages at 30, 60, and 90 DPD.

| Type of debt | 30+ DPD | 60+ DPD | 90+ DPD |

|---|---|---|---|

| Auto loan | 4.68% | 1.73% | N/A |

| Credit card | 5.57% | 3.96% | 2.89% |

| Mortgage | 3.42% | 1.72% | 1.13% |

Accounts in collections can be an indicator of how consumers are faring in general. Since 2020, average collection balances in Florida have dropped, from $2,927 to $2,732. This follows a nationwide trend. In 2020, collection balances averaged $3,815. By 2025, they were down to $3,040, a drop of nearly 21%.

Florida Statute of Limitations on Credit Card Debt Collection

Under Florida state law, creditors have five years to collect on most kinds of debt. After that, you’ll still technically owe it and it'll appear on your credit report for up to seven years, but your creditor can’t legally collect it. If a creditor or debt collector tries to sue you and you think the statute of limitations has run out, you could ask the judge to throw out their lawsuit. Some creditors try to collect on old, uncollectible debt, hoping you’ll pay, but that doesn’t mean they have the right to do so.

Be careful about what you say to debt collectors who call you about an old debt. If you agree to make a payment on the debt, that could restart the clock on the statute of limitations. Even something as simple as acknowledging the debt when talking to a debt collector could reset the statute of limitations in some cases.

| Type of debt contract | Florida statute of limitations |

|---|---|

| Written contracts | 5 years |

| Oral contracts | 4 years |

| Promissory notes | 5 years |

| Open-ended accounts (such as credit cards) | 5 years |

What are the Florida debt collection laws?

You have protections from debt collectors under both federal and Florida state law. Here’s a sample of some of the key consumer protections in place in the Sunshine State:

Collectors can't use threats or obscene language.

Collectors can't impersonate a government official.

Debt collectors must accurately identify themselves and provide written notice of the debt within five days of their initial contact.

Debt collectors can only call between 8 AM and 9 PM.

Collectors can't harass family members or employers.

You have the right to insist that the debt collector stop contacting you.

You have the right to dispute the debt by sending a letter to the collection agency within 30 days of first contact.

Reviews and Testimonials from Florida

You have been so helpful and I am slowly having my inner peace returning! Thank You for Your help!

Nina, US

Always help full

Bruce Bettcher, US

Able to contact a representative very quickly.

Mark Pronto, US

Florida Debt Relief

If you’re faced with overwhelming unsecured debt that you can’t afford to pay, a debt relief program is a legitimate option. When you’re enrolled in a debt relief program, you make a single monthly deposit into a dedicated account that you own and control. The debt relief company you’re working with then negotiates with creditors on your behalf, potentially significantly reducing your debt. A debt relief program typically takes as little as 24 to 48 months to complete.

Debt relief is for someone who genuinely can’t afford to fully repay their debt.

Most people who pursue debt settlement are behind on their debt payments. Anytime you fall behind on your payments, your credit score is likely to suffer. If your score is already low due to missed and late payments, settling a debt may not make a significant impact. However, the debt will typically be noted as “settled” on your credit report, which is better than an open collection account but not as good as “paid as agreed.” With time and regular on-time payments, your score could improve over time. While you’ll have to be patient, there’s no reason to believe you can’t rebuild your score to where it was and beyond.

If you’re looking for a debt relief program in Florida, call Freedom Debt Relief at 800-910-0065. You can speak with a Debt Consultant about your financial situation and develop a plan that aligns with your income and expenses.

Freedom Debt Relief is not a credit repair organization and does not provide or offer services or advice to repair, modify, or improve your credit.

What Is the Best Debt Relief Solution?

The term “debt relief” can encompass a range of measures. Here are four of the main types of debt relief, including consolidation:

Debt settlement: An agreement with your creditor to accept less than the full amount you owe and forgive the rest. You can settle unsecured debts yourself or work with a professional debt settlement company. Typical debt settlement programs take two to four years to complete.

Debt management plan: A three- to five-year plan to fully repay your unsecured debt, administered by a nonprofit credit counseling agency. Your creditors may reduce interest rates or waive fees. Your credit counselor can help you learn more money management skills.

Bankruptcy: Chapter 7 bankruptcy wipes out unsecured debts in a few months. You might lose some of the things you own (to be sold by the court, and the money given to your creditors). If you earn too much to qualify for Chapter 7, you'll be directed to Chapter 13, a three- or five-year repayment plan.

Debt consolidation: A new loan that you use to pay off multiple smaller debts. For example, you might consolidate two $1,000 credit card debts with 20% APRs into a single $2,000 personal loan with a 14% APR and smaller monthly payments.

If you’re seeking relief from debts, you don’t have to go it alone. Speak with a debt professional who can help you explore your options and find the solution that best fits your situation.

Common Debt Relief Questions in Florida

Here are the answers to some questions you may still have about dealing with debt in the Sunshine State.

How to find legitimate non-profit credit counseling services in Florida

You can find reputable nonprofit credit counseling agencies nationwide—including Florida—by getting a referral from the National Foundation for Credit Counseling or the Financial Counseling Association of America. These organizations represent hundreds of member agencies and thousands of individual counselors. You can also find credit counseling agencies on your own.

When shopping for a reputable agency, consumer advocates recommend you:

Read reviews and ratings from actual customers online.

Look for agencies that offer free initial counseling sessions.

Check with the office of your state’s attorney general to verify the agency.

Ask if the agency offers services on a sliding fee scale, based on income.

Check for a counselor’s qualifications and certifications.

If opting for a debt management plan, ask about initial setup and monthly fees.

Ask if counselors are paid on commission (which may skew their advice) or a set wage.

Choose agencies that offer a range of counseling options, not just debt management plans.

Average cost of debt relief services in Florida

At Freedom Debt Relief, fees range from 15% to 25% of your enrolled debts. The fee is collected after the company successfully negotiates an agreement with your creditor, you approve it, and at least one payment is made. In other words, for every $10,000 in credit card debt that’s successfully settled, you’ll pay between $1,500 and $2,500.

In addition to the debt settlement fee, there are other debt relief costs. You may have to pay a monthly maintenance fee for the bank account where you build up funds for offering your creditors. This maintenance fee is collected by the bank, not the debt settlement company.

If the debt settlement company isn’t able to negotiate your debts, you may owe more fees and penalties. If they’re successful, you may owe income taxes on the forgiven debts.

Other types of debt relief come with extra costs, too. Debt consolidation loans often charge origination fees, and debt management plans often charge setup and monthly fees.

Compare pros and cons of debt management plans vs. debt settlement in Florida

At first glance, debt management plans and debt settlement look similar. Here are the differences.

Debt management plan pros:

Streamlines monthly debt payments

Could reduce interest rates and waive fees

Financial education and support

Debt expert handles communication with your creditors

One-on-one support throughout the program

Debt management plan cons:

Unsecured debts only

Monthly payment can be very high

Most people pay monthly fees

You'll probably have to close your credit cards

Initial negative impact on credit score

Doesn’t reduce your debt

Debt settlement pros:

Could substantially reduce the debt amount

Knocks down debts faster than minimum payments

Affordable payments

No upfront settlement fees

Debt expert handles communication with your creditors

One-on-one support throughout the program

Debt settlement cons:

Works with unsecured debts only

Forgiven amounts may be taxable

You’ll pay fees if you work with a professional debt settlement company

Negative impact on credit standing

Creditors could still pursue you for the debts

Florida debt consolidation eligibility requirements

Florida’s state government has no special debt consolidation programs for residents. Floridians can apply for debt consolidation loans with private lenders, just the same as residents of any other state.

Each lender is free to set its own eligibility requirements, and there's some variation between lenders. That said, your chances of getting approved for a debt consolidation loan go up if you can meet the following requirements:

Credit score of 620 or higher

Stable, consistent monthly income

36% or less debt-to-income ratio—the percentage of your monthly income that goes toward housing and minimum debt payments

The requirements can also vary depending on the type of loan you use to consolidate your debt. You don’t always need collateral to back up a personal loan, for example. If you use a home equity loan to consolidate debt, you need to have enough equity to borrow against.

Are there specific Florida programs for medical debt relief?

No, Florida has no specific medical debt relief programs. That doesn’t mean you’re out of luck, though.

Medical providers sometimes offer interest-free payment plans. Some may even offer discounts or financial assistance if you qualify. Providers can also direct you to special medical financing options, like deferred-interest credit accounts. Deferred interest means interest-free as long as you repay the debt in full by the deadline. If you don’t, you’ll be charged interest back to the date of the transaction.

If you’re low-income and have certain chronic illnesses, you may be able to get help. Check the archives of the National Financial Resource Directory, operated by the Patient Advocate Foundation.

Also, check the Statewide Medicaid Managed Care (SMMC) program in your state. This program might help you reduce your healthcare costs going forward, allowing you to catch up on your current medical debt.

Many pharmaceutical companies offer medication at low or even no cost to eligible individuals. Information is typically on the manufacturer's website or through resources like NeedyMeds.org or the Medicine Assistance Tool.

Florida government assistance programs for credit card debt

Florida, like most states, has no special government assistance programs if you’re having a hard time dealing with credit card debt. You’ll need to find ways to handle your debt, such as with a debt consolidation loan or with other options. For example, a nonprofit credit counseling agency could enroll you in a debt management plan.

Other strategies include working with a debt settlement firm or filing for bankruptcy. Depending on your income and personal situation, you may also be eligible for public assistance programs. For example, Supplemental Security Income for disabled people, which can offer extra funds that you could use to help pay down your credit card debt. The nonprofit resource 211.org (which you can contact by phone) can help you find other support options.

Floridians can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

What is the impact of filing for bankruptcy on your credit score in Florida?

The impact of filing for bankruptcy depends on the type of bankruptcy you’re filing. In general, a bankruptcy could lower your credit score by as much as 200 points, depending on your individual situation.

If you file for Chapter 13 bankruptcy, the information will stay on your credit report for seven years. The negative impact will diminish over time. A Chapter 13 bankruptcy requires you to make debt payments over five years (three years if you’re low-income).

A Chapter 7 bankruptcy could wipe out some or all of your unsecured debts in a few months. It stays on your credit report for 10 years. The effect on your credit will be less as the years go by, even before it falls off your credit report entirely.

What are the main types of debt relief programs available for Florida residents?

Florida residents have many choices when it comes to debt relief programs. Debt consolidation could be a good option if you simply need a more affordable payment. Many credit counseling agencies also offer debt management plans that could help you pay back your debt with guidance and support, and possibly more favorable terms.

If you’re really struggling to make your unsecured debt payments, a debt settlement company could help you negotiate for partial debt forgiveness. Bankruptcy, a legal process, could be a good option in some cases if it helps you do a financial reset or get caught up on delinquent accounts. Florida has some of the most generous bankruptcy laws in the nation. In Florida, you’re allowed to keep more of your personal property than in other states.

Aside from the generous bankruptcy exemptions on personal property, Florida residents have the same options as people in other states. In other words, the state of Florida doesn’t operate any special debt relief programs for residents.

Florida laws regulating debt settlement companies

Florida has no specific laws that regulate how debt settlement companies operate. Instead, debt settlement companies are directly regulated under federal law by the Telemarketing Sales Rule, which is enforced by the Federal Trade Commission (FTC). This law bans debt settlement companies from charging upfront fees and misleading customers about their debt relief possibilities.

Florida does regulate how credit counseling agencies, which are similar, can do business in the state. For example, a credit counseling agency can’t charge you more than $50 to set up a debt management plan, one of the most common ways that agencies help their customers. Credit counseling agencies can’t charge more than $10 per month for a debt management plan, either. Under Florida state law, agencies must send out your monthly payments to each creditor included in your debt management plan within 30 days, to avoid any delays or late fees.

End Your Debt

Find out how our program could help.

- One low monthly program deposit

- Settlements for less than owed

- Debt could be resolved in 24-48 months