Idaho Debt Relief: What’s Changed in the Past Five Years?

Residents of the Gem State get to enjoy beautiful scenery along with the delicious potatoes for which the state is famous. And like many Americans, Idahoans are also managing a fair amount of debt. An average resident of Idaho owed about $66,800 as of 2024. That figure is slightly above the average among Americans the same year, which was about $61,700 (both figures per the Federal Reserve Bank of New York).

Freedom Debt Relief’s data from the last five years shows that some Idaho residents are likely struggling to make debt payments. Those who reached out to Freedom Debt Relief for help in 2024 had a debt-to-income ratio of 40%, which is often unsustainable alongside other essential bills, like housing. Their average total debt that year (including large loans like mortgages) totaled $367,526, including $75,817 in unsecured debt like credit card balances, personal loans, or medical bills.

Let’s take a closer look at five-year debt trends in Idaho and explore debt relief options that could give you some breathing room in your budget.

Idahoans can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

5-Year Debt Trends in Idaho

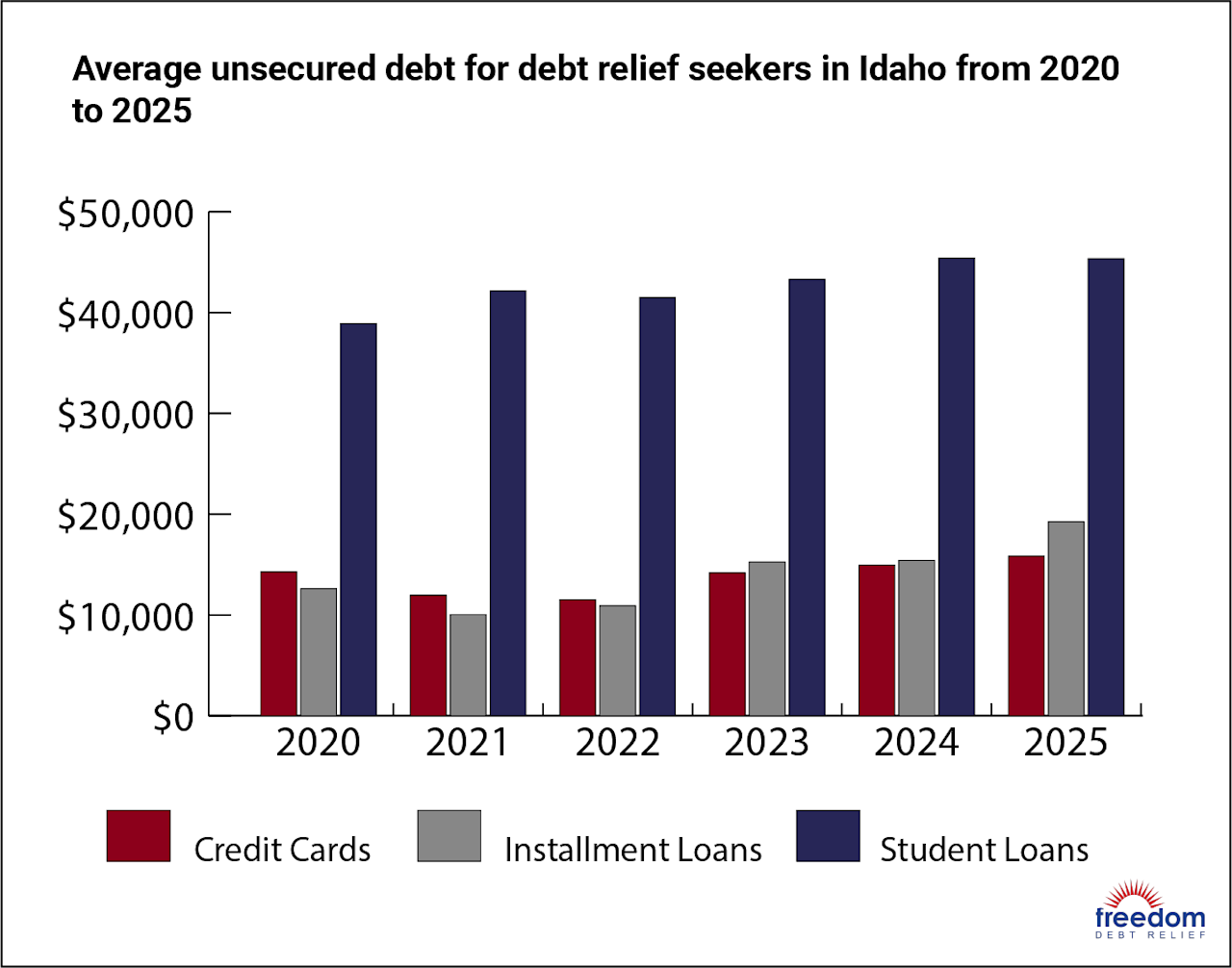

Among Idaho residents, debt levels have risen noticeably since 2020. For that year, Freedom Debt Relief’s data shows an average unsecured debt figure of $65,845, which grew to $75,817 in 2024, a gain of 15.1%. That’s a more dramatic increase than what debt seekers nationwide saw. Across the country, debt seekers’ unsecured debt averaged $69,323 in 2020 and $76,079 in 2024, an increase of 9.75%.

As the data shows, your stage of life and your credit score have an impact on how much money you owe. For unsecured debt, the highest 2024 average among age ranges in Idaho was $87,224 for the group aged 51 to 65. Those with a FICO Score between 800 and 850 (considered excellent) owed the most unsecured debt in 2024, at $108,011.

Debt collection efforts for Idaho residents are on the decline. Between 2020 and 2024, the average number of collection accounts among Idahoans who contacted Freedom Debt Relief fell a lot, going from 4.6 to 2.3. Over the same period, Americans overall saw their number of collection accounts decline from 3.3 to 2.0.

What about the balances of those collection accounts? Among debt relief seekers in Idaho, the amounts in collections went from $5,235 in 2020 to $3,815 in 2024, a drop of 27%. This is in line with national trends. Nationwide, debt relief seekers saw their average collection account balance fall from $3,815 in 2020 to $3,183 in 2024.

Idaho credit card debt

The average credit card debt balance for Idaho residents in 2020 was $14,296, and rose slightly to $14,959 in 2024. Those figures represent an average of 7.1 credit cards in both years. Compare that to debt relief seekers nationwide in 2024. Their average balance was $15,636 across 7.6 cards, meaning Idahoans have a little less debt on average, and slightly fewer credit cards. In 2024, Idaho residents paid an average of $422 per month on their credit card balances, while debt relief seekers nationwide paid $487.

In 2024, Idahoans had an average credit utilization of 75.2%. Utilization is your credit card balance compared to your credit limit. If you have a $750 balance on a card that has a $1,000 limit, your utilization is 75%. High utilization indicates that you might be in over your head with debt.

Credit cards typically come with high interest rates, and interest is charged on your balance daily. Plus, if you pay just the required monthly minimum payment on your account, you won’t make much progress on paying down your balance. The longer you take to repay a debt, the more interest you’ll pay. If you’re struggling with credit card debt in Idaho or anywhere in the country, explore your options for credit card debt relief.

Idaho auto loan debt

Idahoans had an average of 1.5 auto loans in 2024, and paid an average of $580 per month on these installment loans. Another way to think of this is that for every two Idaho debt seekers, there are three car loans. The average auto loan balance for an Idaho resident in 2024 was $25,834.

Nationwide, debt relief seekers have the same average number of auto loans and pay $726 per month toward them. Debt seekers nationwide had an auto loan balance of $26,839 in 2024, slightly higher than the average balance among residents of the Gem State.

Idaho mortgage debt

On average, Idahoans had 1.1 mortgage accounts in 2020; that rose to 1.2 by 2024. In other words, some people in Idaho have more than one home loan. Those average open mortgage balances also rose, from $163,524 to $265,876—not surprising, given the jump in home prices since the COVID-19 pandemic. By 2024, the average monthly mortgage payment was $1,766.

On a national level, debt relief seekers had 1.1 mortgage accounts, with a balance of $241,535 and a monthly payment of $1,949.

Idaho installment loan debt

Balances on installment loans (like personal loans) in Idaho rose noticeably between 2020 and 2024, going from $12,623 to $15,423, a jump of 22.2%. For the same period, debt seekers nationwide had an average balance of $10,620. The number went down a few dollars to $10,582 in 2024. For 2024, that Idaho installment loan balance was spread across an average of 2.7 open loans, while debt relief seekers nationwide had 2.9 open loans.

The average monthly payments on these balances in 2024 was $232 for Idaho residents and $436 for all debt relief seekers in the U.S.

Idaho student loan debt

Student loan debt is another part of the Idaho financial picture where the average balance figure rose between 2020 and 2024—from $38,926 to $45,435. That was spread across an average of 4.2 student loan accounts in 2020, and 5.4 in 2024. The cost of higher education is on the rise, which likely accounts for those seeking higher education needing to take out more in loans. In 2024, the average monthly payment on student loan accounts was $129.

Student loan debt has spiked on a national level, too. In 2020, the average balance for debt relief seekers nationwide was $42,151. In 2024, that figure had risen to $49,861. The corresponding monthly payment rose from $251 to $298, making student loans a little more burdensome on people’s budgets..

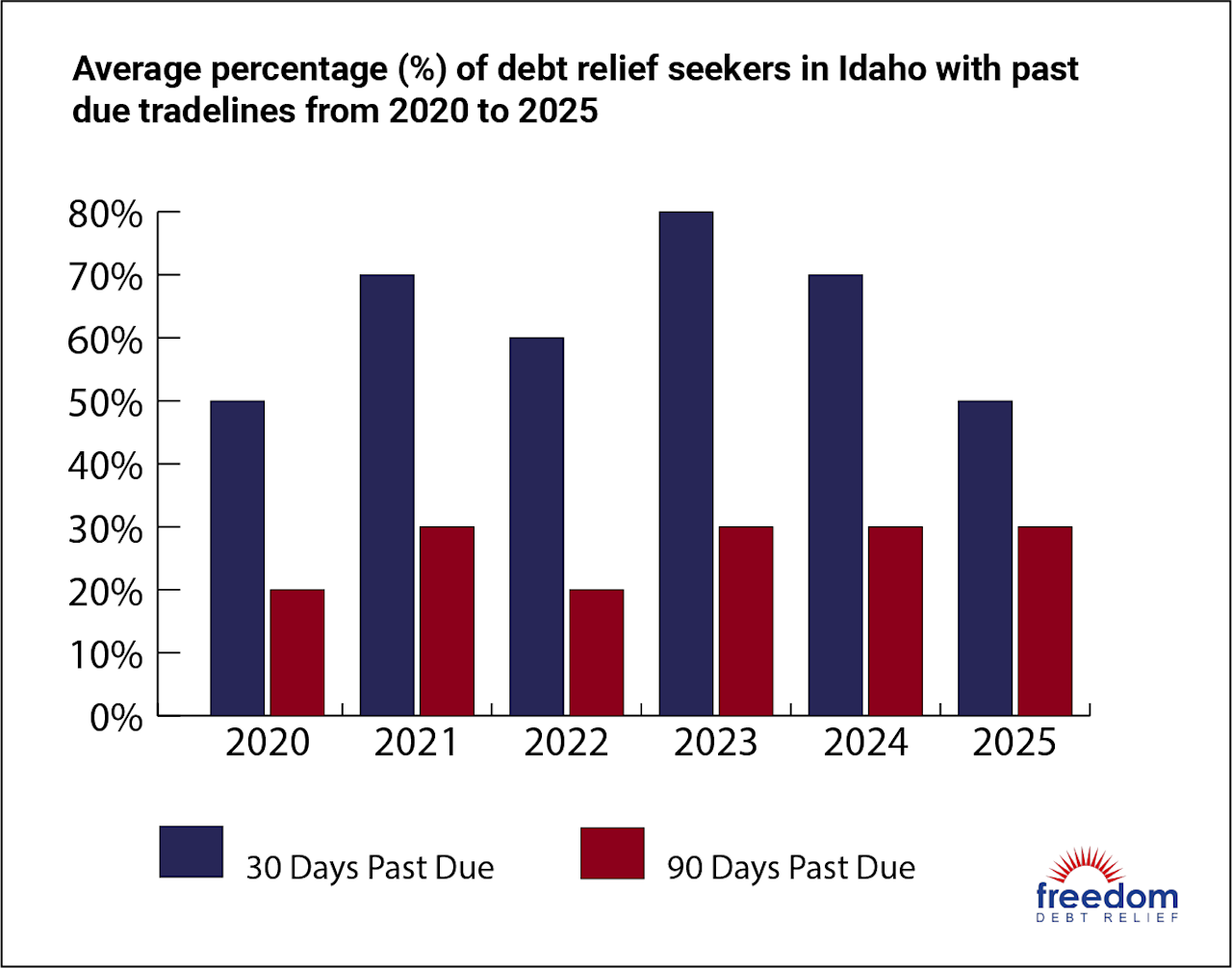

Idaho Debt Delinquencies and Collections

One measure of debt stress is the rate of debt delinquency. According to data from September 2025 collected by credit bureau TransUnion, Idaho residents are doing better than borrowers nationwide payments that are 30, 60, and 90 days past due (DPD). Here’s a table showing national average delinquency rates.

| Type of debt | 30-plus DPD | 60-plus DPD | 90-plus DPD |

|---|---|---|---|

| Auto loan | 4.34% | 1.65% | N/A |

| Credit card | 4.66% | 3.27% | 2.37% |

| Mortgage | 2.89% | 1.36% | 0.85% |

And here’s a table with the figures for Idaho:

| Type of debt | 30-plus DPD | 60-plus DPD | 90-plus DPD |

|---|---|---|---|

| Auto loan | 2.72% | 1.06% | N/A |

| Credit card | 3.26% | 2.23% | 1.61% |

| Mortgage | 2.11% | 0.94% | 0.60% |

It’s encouraging that Idahoans have a lower percentage of delinquent loans than Americans overall, but that doesn’t mean they have no debt in collections.

Among debt relief seekers in Idaho, collections balances have fallen, from $5,235 in 2020 to $3,815 in 2024, 27% lower. The average number of accounts in collections went from 4.6 in 2020 to 2.3 in 2024.

National trends also show collections balances falling. Debt relief seekers nationwide watched their collections balances fall slightly from $3,815 in 2020 to $3,183 in 2024, a dip of almost 17%.

Idaho Statute of Limitations

The statute of limitations on debt is the deadline for filing a lawsuit. The number of years varies by state, typically ranging from three to 10. After the statute of limitations has passed, any legal claim is invalid. If you’re sued, you could ask the judge to throw out the lawsuit.

In Idaho, the statute of limitations for debt depends on whether the debt contract is written.

| Type of debt | Idaho statute of limitations |

|---|---|

| Written | 5 years |

| Oral | 4 years |

What are the Idaho debt collection laws?

Debt collection agencies operating in Idaho are bound by the Fair Debt Collection Practices Act (FDCPA), a national law governing your rights as a debtor (someone who owes money). This law keeps collections agencies and debt buyers from harassing you and treating you unfairly. For example, it tells debt collectors not to contact you before 8 a.m. or after 9 p.m., and if you tell them to stop contacting you or your family, the debt collector must listen.

It’s important to note that the FDCPA doesn’t apply to the original creditor you owe money to, only to the collection agency they might hire, or the debt buyer who purchases your debt and attempts to collect it.

Reviews and Testimonials from Idaho

People were great attention to detail explanation very good very considerable about helping me through my situations very understandable and easy to get along with

Michael Garceau, US

Very informative and helpful

Amir Mizany, US

I'm so grateful for freedom Debt relief. I would recommend this system to everyone that have financial issues knowing i was living off paycheck by paycheck. To cover these bills my best decision was to contact freedom debt relief. They are very nice, easy to talk to and they recommend the best solution that they could use to help me.

Nathaniel Grant, US

Idaho Debt Relief

If you’re struggling to manage your debt and can’t figure out a way to fully repay what you owe, a debt relief program might be a good option to explore. You work with a professional debt relief company that negotiates with your creditors on your behalf. The goal is to get them to agree to accept less than you owe. This debt solution is best suited for people having trouble making debt payments due to a financial hardship. You can also negotiate with creditors on your own.

If you enroll in a debt relief program, they’ll set up a dedicated account to deposit money into every month. This money will be used to settle your debts once your Debt Consultant has reached agreements with your creditors and you approve those agreements.

You own and control the account. The debt settlement company’s fee is paid from the same dedicated account. A reputable debt relief company will not charge you upfront for debt settlement services—only after an agreement is reached with your creditor, you approve it, and at least one payment to your creditor has been made. A debt relief program takes as little as 24 to 48 months to complete, and the amount of your monthly deposits could be less than you were paying monthly on your debts.

Need help with debt in Idaho? In 2024, Idaho debt relief seekers enrolled an average of $32,076 with Freedom Debt Relief.

Is Debt Consolidation the Best Debt Solution?

There are many ways to cope with debt, in Idaho or anywhere else in the country. Here’s an overview of your options.

Debt settlement

If you’re struggling with a financial hardship and can’t figure out a way to repay what you owe, a debt settlement program could be worth exploring. In this type of debt relief, you negotiate with your creditors (or work with a debt settlement company that does it for you) to reach an agreement to settle your debt for less than you owe. You can expect the process to take some time (the average for Freedom Debt Relief is two to four years). To settle debts, you need money to offer your creditors. You’ll set it aside over time.

Debt consolidation

If you can afford to fully repay what you owe, but want to organize and/or potentially reduce the cost of your debt, consider streamlining repayment with debt consolidation. Consolidating your debts means taking out a new loan (often a personal loan or home equity loan) and using that to repay credit cards or other debts. Then you pay off the personal loan or home equity loan. This debt solution works best if you qualify for a new loan with a lower interest rate compared to what you’re paying now.

Bankruptcy

Bankruptcy is another possible option to deal with debt. Many unsecured debts could be wiped out entirely if you qualify to file Chapter 7 bankruptcy. Chapter 7 bankruptcy is income-limited. The bankruptcy court might require you to give up some of the things you own. They will be sold, and the money given to your creditors. You won’t be left with nothing, but you generally can’t keep a second car, a second home, or luxury goods.

In a Chapter 13 bankruptcy, you keep everything you own but commit to a repayment plan. For most people, the plan lasts five years. If your income is lower, you might qualify for a three year plan.

DIY debt payoff

If you can afford to repay what you owe and you like a good DIY project, consider trying a DIY debt payoff plan, like the debt snowball or the debt avalanche.

With the debt snowball, you organize your debt balances from lowest to highest. You send extra money to your smallest debt first, while you keep making minimum payments across all your balances. When that first one is paid off, you send the extra money to the next-smallest balance, continuing this way until you’re debt-free.

For the debt avalanche, you focus extra money on the debt with the highest interest rate first. When that’s paid off, you move on to the balance with the next-highest rate, and so on.

The debt avalanche could save you money in the long run. The debt snowball is the quickest way to paying off your first debt, which could be highly motivating.

Debt management plan

If you have the money to repay what you owe and need help getting organized, a debt management plan (DMP) could be right for you. You work with a credit counseling agency (these are nonprofits and are typically funded by credit card companies) to create a plan to fully repay your unsecured debts over three to five years with regular monthly payments. If you enroll in a DMP, you might also get help with budgeting and other financial concerns, so you could come out the other side in a stronger place financially.

Idahoans can free up cash each month with Freedom Debt Relief

Ozzy S., Freedom client²

“Right away, I had more money each month because of program costs so much less than what I was paying on my minimums.”

Excellent •

Is there a government debt relief program for credit cards?

There is no government debt relief program that can help you with credit card debt. But you have other options to deal with credit card debt in Idaho or anywhere in the country. A debt relief program could help you settle your debts for less than you owe if you’re struggling to afford your debt. If you need help getting organized to pay off what you owe, a DIY debt payoff plan like the debt snowball or debt avalanche could be a fit.

Is it a good idea for Idaho residents to use a debt relief program?

It could be, if you are struggling with a financial hardship and can’t fully repay your balances. Doing so could mean getting free of debt for less than you owe. And making one monthly payment to your dedicated account to repay creditors is easier than managing multiple debt payments.

What are the 11 words to stop a debt collector?

The idea that there are 11 words to stop a debt collector is a myth. You can get a debt collector to stop contacting you if you say “Please cease and desist all calls and contact with me immediately.” But once you say this phrase, the debt collector has no other option but to sue you. If you keep the lines of communication open, you could work out a deal, such as a debt settlement.

The only time to tell a debt collector to cease and desist is if you’re sure the debt is uncollectible. For example, if you are certain the debt is not yours.

End Your Debt

Find out how our program could help.

- One low monthly program deposit

- Settlements for less than owed

- Debt could be resolved in 24-48 months