Can a Credit Card Company Sue You?

- Credit card companies can sue you over unpaid credit card debt.

- You generally have at least six months before creditors consider legal action.

- Don’t ignore a lawsuit. It won't make it go away, and you could lose your right to defend yourself.

Table of Contents

- When Credit Card Companies Sue for Unpaid Debt

- Who Can Sue You for Credit Card Debt?

- What Happens If You're Sued for Credit Card Debt

- Why You Should Always Respond to a Credit Card Lawsuit

- Options If You're Sued for Credit Card Debt

- Can a Credit Card Company Sue You If You’re in a Debt Settlement Program?

- How to Avoid a Credit Card Lawsuit

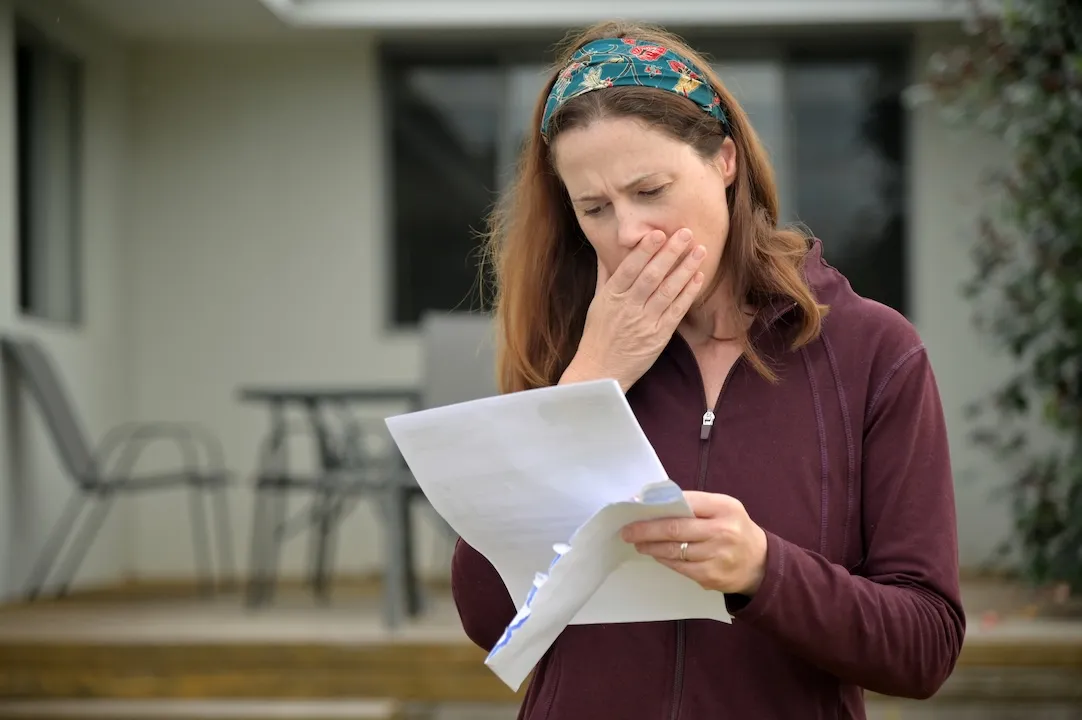

Many of us have been there. You hoped to be caught up, but it's been six months and your credit cards are still past due. The credit card company has given up on getting paid and decided to sue you.

The unfortunate truth is that credit card companies do have the right to sue you over unpaid debt. It's rarely the first option—they usually try to collect in other ways before they get to this point. But if that doesn't work, a lawsuit could be on the horizon.

There’s hope, even then. If you've been sued by a credit card company, you may still have options that don't involve a courtroom. We'll explore when credit card companies sue, what the process involves, and what options you may have.

When Credit Card Companies Sue for Unpaid Debt

Lawsuits are expensive. So most credit card companies try everything possible to collect before they sue. Here's a general overview of what the timeline could look like:

A few days past due: You might get a reminder to pay your bill, and your credit card company might automatically tack on a late fee. But there isn’t any credit score damage yet, nor risk of legal action.

30 days past due: This is when your account is officially delinquent. You get calls and letters asking for immediate payment.

60-90 days past due: Collection efforts are stepped up, and the calls could become frequent. The delinquent account will probably be reported to the credit bureaus.

120 days past due: At this point, your account is likely to be sent to the internal collections department. The damage to your credit becomes more severe.

180 days past due: After about six months, the credit card company may give up on getting paid through regular collection methods. Your account may be charged-off and sold to a collections agency. Or the credit card company may sue.

A company’s policies guide whether they sell your account to debt collectors or sue you. However, if you have a very large balance, or the company believes you have the means to pay and choose not to, the odds of a suit may increase.

Some reports suggest credit card companies are less likely to sue for amounts below $2,700. This isn't a hard rule or cutoff, though. You could get sued even if you owe less than $2,700, either by the original creditor or a debt buyer.

Who Can Sue You for Credit Card Debt?

Knowing who is suing you could help you determine your rights and options. For instance, the Fair Debt Collection Practices Act (FDCPA) doesn't apply to original creditors—only debt collectors and most debt buyers.

With that in mind, a lawsuit over unpaid credit card debt could come from:

Your original creditor. The credit card company could sue you directly.

A debt buyer. If the credit card company sells your unpaid debt, the new owner could sue you.

A debt collection agency. If the original creditor or debt buyer hires a debt collection agency, the debt collector could sue you.

Their right to sue you over an unpaid debt doesn't last forever. Every state has a statute of limitations for debt. The statute of limitations is the period in which they can come after you for an unpaid debt. Once that time runs out, they could technically still sue you, but the court would consider the debt time-barred and uncollectible. In most states, the statute of limitations for credit card debt is three to six years (though it's longer in a few states).

Courts don’t automatically throw out lawsuits over old debts. You would still need to answer the lawsuit and show up to court and explain why you don’t think the lawsuit is valid. If you fail to answer the lawsuit or appear in court, the creditor could win a default judgment against you, and that could be hard to reverse.

Credit card companies and debt collectors could also try to collect in other ways on debts that are past the statute of limitations. An important note: Even after the statute of limitations has passed, the clock can reset if you make a payment, or sometimes if you acknowledge the debt.

What Happens If You're Sued for Credit Card Debt

You'll know you've been sued when you receive a summons (official notice) and a copy of the complaint, which details why you're being sued. These documents identify the plaintiff (usually the credit card company or a debt collector) and the defendant (you). It should also list the amount being claimed, your court date, and how to respond.

You typically have 20-30 days after you're served to respond to a summons, depending on your state (the exact deadline should be listed on your documents). Put this deadline on your calendar, in your phone, on your forehead—whatever you need to do to make sure you don't miss it.

After you respond, the lawsuit typically moves to the discovery phase. This is when information about the case is shared, and documents are provided by both sides.

Finally, the court makes a decision. It could decide in your favor or the credit card company's favor, or it could dismiss the case (that could happen if there is a technical error, such as an issue with paperwork). If you lose the case, the credit card company can then ask the judge to allow it to collect. This could lead to bank account or wage garnishment, property liens, or the seizure of property.

No matter how the court finds, credit card debt is a civil matter, not criminal. You don’t risk going to jail over unpaid credit card debt.

Why You Should Always Respond to a Credit Card Lawsuit

Lawsuits do not go away if you ignore that they exist. Your only chance at a positive outcome is to face it head-on. If you ignore a credit card debt lawsuit, the most likely outcome is a default judgement, which means the credit card company wins by default. You lose the chance to defend yourself, and you must abide by the court's ruling.

Responding to the lawsuit is the only way to protect your rights and keep your options open.

Options If You're Sued for Credit Card Debt

Being sued can be scary, but you've still got options. When you receive a summons for a credit card debt lawsuit, you could:

Seek legal counsel. People who seek legal advice tend to have better outcomes than those who don't. Choose an attorney specializing in debt defense who’s licensed to operate in your state. If you're not sure where to start, contact a nearby legal aid organization.

Respond on your own. You aren't legally required to consult an attorney. You could respond to the lawsuit yourself, but this generally isn't the best option.

Ignore it and hope it goes away. Spoiler alert: It won't. You’re likely to lose by default judgment.

After responding to a summons, you can consider moving forward in one of the following ways.

Challenge the lawsuit

As long as you respond by the deadline, you can defend yourself and challenge the lawsuit. For instance, you can request debt validation to verify that the debt is actually yours and the amount is correct.

There are other valid defenses to debt lawsuits. For example, the debt could be time-barred, meaning the statute of limitations has passed. Consult an attorney to find out the best way to challenge the lawsuit if this is the path you wish to take.

Negotiate a debt settlement

Debt settlement is when you negotiate with your creditors to accept less than you owe to get rid of your debt. This works best before a lawsuit has been filed, but you may still be able to negotiate a debt settlement after you've been sued. Creditors know they aren’t guaranteed to win in court.

File for bankruptcy

If you're certain you can't afford your debts, you could consider filing for bankruptcy. Bankruptcy can at least temporarily stop debt lawsuits. Chapter 7 bankruptcy could help you get rid of unsecured debts if your income qualifies. It may involve the court selling some of your assets to pay debts. Chapter 13 bankruptcy could be an option if you're interested in restructuring your debt and saving your assets. Consult with a bankruptcy attorney to learn more about your options.

Can a Credit Card Company Sue You If You’re in a Debt Settlement Program?

Yes. Even if you're in a debt settlement program, your credit card company could sue you for unpaid debts. Enrolling in a debt settlement program doesn’t prevent debt lawsuits. Only bankruptcy can temporarily stop them.

How to Avoid a Credit Card Lawsuit

The best way to avoid a lawsuit over credit card debt is to deal with the debt before it reaches that point. And this starts with communication. As soon as you know you're going to have trouble making a payment, contact your creditors. They may have options to help you avoid falling behind, such as a hardship program that delays a payment until you're back on track.

Even if you're already behind, it generally takes at least six months before a creditor considers a lawsuit. You could still seek debt relief by working out a payment plan, consolidating your debt, or attempting debt settlement before the court gets involved. You have options, and the earlier you take action, the more options you have.

Author Information

Written by

Brittney Myers

Brittney is a personal finance expert and credit card collector who believes financial education is the key to success. Her advice on how to make smarter financial decisions has been featured by major publications and read by millions.

Reviewed by

Kimberly Rotter

Kimberly Rotter is a financial counselor and consumer credit expert who helps people with average or low incomes discover how to create wealth and opportunities. She’s a veteran writer and editor who has spent more than 30 years creating thousands of hours of educational content in every possible format.

How long does it take for a credit card company to sue you?

Credit card companies typically wait until a debt is at least 180 days past due before taking legal action.

Can you go to jail for credit card debt?

No. Credit card debt is a civil matter, not criminal.

Can you settle credit card debt after being sued?

Potentially. Debt settlement works best before a lawsuit is filed, but it might still be possible after you've been sued.

What is the minimum amount a credit card company will sue for?

A credit card company could sue over any amount of unpaid debt. Some reports suggest balances below $2,700 are less likely to lead to lawsuits, but there is no legal minimum.