Your Emergency Financial First Aid Kit

ByTanya Sotos

UpdatedJul 5, 2025

- Everyone needs a financial emergency kit.

- Your kit should include emergency savings or at least an emergency line of credit.

- You also need to have your financial documents in a safe place.

What is a Financial Emergency Kit?

The worldwide coronavirus (which causes COVID-19 illness) pandemic has everyone thinking about emergencies. We are all worried about how to manage not only our immediate health and safety, but the long-term well-being of ourselves and our families. This includes our money, because we can’t build a future without it.

Everyone uses physical first aid kits during emergencies, but what about an emergency financial first aid kit? Is there any such thing? There is, and getting a financial emergency kit in order can help you protect your family’s finances right now, and for the years to come.

Key Actions from the FEMA Emergency Financial First Aid Kit

Getting your financial information together in an emergency is something you might not have thought about. Beyond the current coronavirus pandemic, if you survived the 2019 wildfires in California, Hurricane Maria in Puerto Rico, or coped with the government shutdown in 2018-19, you know that emergency situations happen fast, and come in all forms. No matter what you are facing, here are some of the key actions that FEMA lists in its Emergency Financial First Aid Kit that can help.

Step 1: Get your legal, ID, medical, and financial documents together

Make sure you have copies of all documents that identify you, family members, and ownership rights to your important property. You should organize both hard copies and electronic copies of all these documents. FEMA suggests you make a checklist of all documents, including:

Legal: Wills and trusts, powers of attorney (POAs), adoption certificates, marriage licenses, child support or custody agreements. Ownership and insurance documents also fall in this category. Have copies of: insurance policies (car, home, health, life, etc.), deed, mortgage, rental/lease agreement.

Identity: Any documents that can prove the identity of all family members. This includes Social Security cards, birth certificates, driver’s licenses/state ID cards, passports/green cards, naturalization documents, military ID, and any pet ownership or microchip documentation.

Medical: Doctor contacts, prescriptions, emergency contacts, health insurance/Medicare cards, and medical equipment documents.

Financial: Last tax returns, government benefits statements, list of bank accounts, and credit and debit cards. Include loan documentation for outstanding debts like student, auto, and property loans.

Make sure you know how to contact your bank and any creditors in case you need money or can’t pay bills for a period of time. Having a full list of your current financial obligations will help you keep your debts in order when you are under stress.

Step 2: Make sure your documents are safe and accessible

You should have hard copies of your most important documents in a fire and waterproof safe in your home or in your safe deposit box at a local bank. You will also want to keep electronic copies on an external drive or stored in the cloud. Due to online security risks, make sure your passwords are updated regularly and meet safety standards.

Do you have an Emergency Fund?

An emergency fund is an easily accessible savings account of money you can draw on if you have a sudden need and is an important part your emergency financial first aid kit. A survey by Freedom Financial Network in 2019 showed most Americans have less than $5,000 saved, and only 53% have any kind of emergency fund. If you have the means, build or add to your emergency fund now.

You can use an automatic payment plan from your bank to put away a portion of each paycheck, or you can physically set aside cash each month. Pay into it like you would pay any other monthly bill. Even if you start by saving just $5 a day, you’ll have $1,825 by the end of the year. One small step can get you on a better path, faster than you expect. The best goal is to save at least 6 months of living expenses such as rent/mortgage, utilities, food, and fuel.

One last thing you may not have thought about – that old fashioned green stuff – cash. Keep a small amount of cash handy for an immediate need. In a large-scale natural disaster, you may not be able to use a debit or credit card.

Do you know how much you need this month?

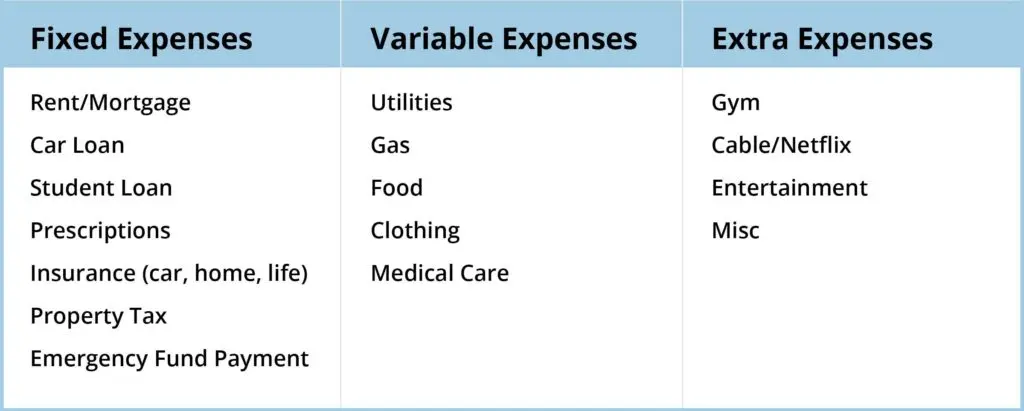

One way to get your emergency financial kit together is to understand how much you need to live each month. Sit down and calculate how much you need, grouping fixed amounts (like rent or mortgage), variable amounts (like utilities,) and extras (like cable) together. It might look like this:

In the case of a pandemic, where school and work closures are common, keep in mind that some expenses will go down (less driving means less gas), but some expenses will go up (more time at home means more electricity and water). You may need to add new expenses like childcare if schools are closed but you still need to go to work.

You should also know you can apply for hardship exceptions and help from the following:

Forbearance for your mortgage

Forbearance from your credit card company

Pull funds from your 401k under a hardship exception

Keep calm and manage on

Surviving a natural disaster like an earthquake or living through a global pandemic like the coronavirus is hard – there is no way around that. But there are steps you can take to make sure you and your family do the best you can during difficult times, including getting your financial emergency kit together.

Remember that government agencies like FEMA, the CDC and NGOs like the Red Cross are here to assist. But we can help each other as well. If you are safe, maybe you’ll want to raise money for others with a GoFundMe campaign. But more importantly, just look out for each other. It will take a global village.

A look into the world of debt relief seekers

We looked at a sample of data from Freedom Debt Relief of people seeking the best debt relief company for them during June 2025. This data highlights the wide range of individuals turning to debt relief.

Credit Card Usage by Age Group

No matter your age, navigating debt can be daunting. These insights into the credit profiles of debt relief seekers shed light on common financial struggles and paths to recovery.

Here's a snapshot of credit behaviors for June 2025 by age groups among debt relief seekers:

| Age group | Number of open credit cards | Average (total) Balance | Average monthly payment |

|---|---|---|---|

| 18-25 | 3 | $8,977 | $276 |

| 26-35 | 5 | $12,592 | $380 |

| 35-50 | 6 | $16,682 | $431 |

| 51-65 | 8 | $17,561 | $535 |

| Over 65 | 8 | $17,781 | $500 |

| All | 7 | $15,142 | $424 |

Whether you're starting your financial journey or planning for retirement, these insights can empower you to make informed decisions and work towards a more secure financial future

Credit card debt - average debt by selected states.

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) the average credit card debt for those with a balance was $6,021. The percentage of families with credit card debt was 45%. (Note: It used 2022 data).

Unsurprisingly, the level of credit card debt among those seeking debt relief was much higher. According to June 2025 data, 88% of the debt relief seekers had a credit card balance. The average credit card balance was $16,425.

Here's a quick look at the top five states based on average credit card balance.

| State | Average credit card balance | Average # of open credit card tradelines | Average credit limit | Average Credit Utilization |

|---|---|---|---|---|

| Ohio | $15,683 | 7 | $24,102 | 84% |

| District of Columbia | $17,396 | 9 | $28,791 | 82% |

| Alaska | $20,496 | 9 | $27,261 | 80% |

| Oklahoma | $15,035 | 8 | $25,731 | 78% |

| Indiana | $14,039 | 8 | $26,156 | 78% |

The statistics are based on all debt relief seekers with a credit card balance over $0.

Are you starting to navigate your finances? Or planning for your retirement? These insights can help you make informed choices. They can help you work toward financial stability and security.

Tackle Financial Challenges

Don’t let debt overwhelm you. Learn more about debt relief options. They can help you tackle your financial challenges. This is true whether you have high credit card balances or many tradelines. Start your path to recovery with the first step.

Show source

Author Information

Written by

Tanya Sotos

Tanya R. Sotos is an attorney, legal blogger, and Senior Content Manager for Freedom Debt Relief. With over ten years of online writing experience, she still works every day to understand the best way to educate and entertain an online reader.