We Weren’t Saving for Retirement Before, Now it’s Even Harder

UpdatedJul 8, 2025

- Research shows that many are unprepared for retirement.

- Unemployment, especially for older workers, makes saving for retirement difficult.

- Clearing debt and establishing a retirement saving habit is critical for workers of all ages.

Table of Contents

When it comes to saving for retirement, many Americans have difficulty building their nest egg because money needs to go to pressing needs like paying bills, saving for short-term goals, and staying on top of debt. Now, due to the increase in unemployment during the coronavirus pandemic, saving for retirement has become an even bigger struggle.

And now, new research published by the Center for Retirement Research at Boston College reveals many Americans might not be able to maintain their pre-retirement standard of living.

Let’s take a closer look at why it may be harder to save for retirement right now, and a few ideas to help you get back to saving consistently.

Widespread unemployment

While unemployment has made it nearly impossible to save for retirement, average retirement savings were not strong pre-pandemic either, with 41% of Americans saying they did not set aside any money for their household retirement plan. Retirement preparedness can be measured using the National Retirement Risk Index (NRRI) created by the Center for Retirement Research at Boston College.

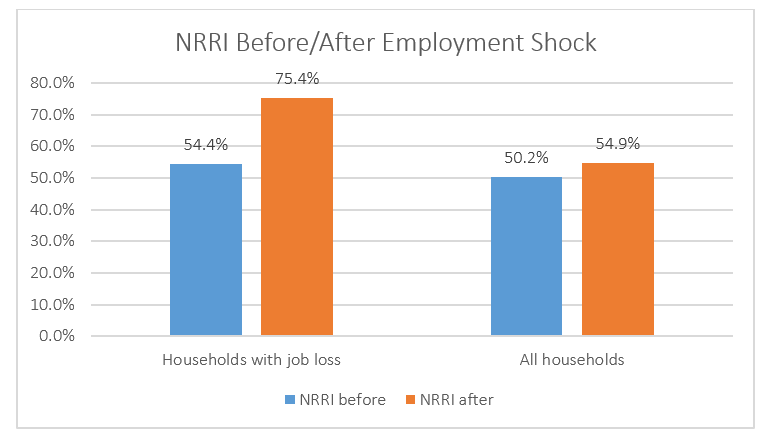

The NRRI measures a household’s retirement income as a percentage of their pre-retirement income to determine who is at risk of not being able to maintain their standard of living later on. More than 75% of households who have experienced job loss are now at risk of not being able to maintain their standard of living during retirement. Even among those still employed, nearly 55% of all households are at risk.

Source: Center for Retirement Research at Boston College

While the risk was high before the pandemic, unemployment has created even more hardship to those who want to retire comfortably. As a result, fewer Americans are able to save each year.

The savings gap has increased

Lack of savings, coupled with unemployment, has led to an increase in the difference between what households have actually saved in a given year and what they should have saved in order to maintain their living standard in retirement.

Savings Gap to Income, by Income Group, Before/After Employment Shock

| Income | Before | After | Percentage Change |

|---|---|---|---|

| Low | 19.7% | 24.2% | 4.5% |

| Middle | 14.4 | 18.1 | 3.7 |

| High | 15.4 | 18.3 | 2.9 |

| All | 16.7% | 20.4% | 3.7% |

Source: Center for Retirement Research at Boston College

Low-income households have been impacted the most by rising unemployment. While the savings gap was nearly 20% for these households before the employment shock, it increased by 4.5% — the highest out of all income groups. So if you’re low income and close to retirement age, you could run a very high risk of not being able to maintain your current lifestyle once you retire.

Older workers are at a higher risk

Older workers who have lost their jobs are often more vulnerable to a rocky retirement because they have less time to make up for lost income before they’ll need to start withdrawing from their investment, pension or government funds. In addition, it can be harder for older workers to become re-employed, even white-collar workers. Those workers typically hold more seasoned positions, like management or senior-level jobs, which can take more time to find and are more costly to employers.

In a normal unemployment scenario, a job search can take between 8 to 12 weeks, but finding an executive-level position can take anywhere from six months to a year. If you’re vying for a top position, that could mean going almost a full year without being able to contribute to your retirement.

But in a time of widespread unemployment, it is not just the high-level managers who will struggle. Blue-collar jobs in the construction and manufacturing industries have nearly tripled in unemployment since last year. While the reality may seem like a blow to your bottom line, there are a few things you can do to continue saving for retirement right now.

Close to retirement? Here’s what to do

If retirement is just around the corner, there’s a few things you can do to tighten your existing savings so you’re better prepared.

Make up for retirement losses by reducing your lifestyle. Now is the time to go inside your budget and look for expenses that you can eliminate. Monthly subscriptions, clothes, and shopping are good places to start, but consider reviewing expenses like insurance premiums. A few changes in coverage could reveal continuing savings.

Keep your investments conservative. As you get closer to retirement, review your investment strategy. Moving to more conservative funds, like bonds or annuities, can help reduce your risk of losing money in the stock market. Discuss your approach with a financial advisor.

Avoid credit card debt. It’s no fun spending your life’s savings on paying down credit card debt, so avoid adding to it. That means using cash to pay for regular purchases and being more mindful of online purchases and impulse buys.

Even once you are employed again, experts recommend continue living a reduced lifestyle so you can push the extra savings towards retirement.

Further from retirement? Steps to take

You still have plenty of time to catch up and keep the coronavirus from impacting your retirement savings if you aren’t close to retirement age, but you still need to start planning.

Contribute to an employer-sponsored retirement plan. A 401(k), 403(b), or Thrift Savings Plan is a great start to building your retirement savings. You can start small while you get back on your feet and progressively work up to a larger contribution later on.

Assess your investment risk level. If you still have decades before you retire, take a look at the types of funds to invest in. Riskier investments, like stocks, are often high risk, high reward. If time is on your side, you may be better able to ride out the dips in the stock market for a better return. Consult with a financial advisor on what could be the best approach for you.

Reduce debt as much as possible. The more you can pay off debt now, the more money you may free up to contribute to your future. Work on a debt pay off strategy and don’t be afraid to enlist a spouse or friend to support you along your debt-free journey.

Debt shouldn’t keep you from saving for retirement

If you are having trouble keeping debt at bay and figuring out life after you retire, there are a few ways to get you back on your feet. Our free debt management guide can walk you through your options on how to manage debt, save money, and choose the right solution, including our debt relief program. Start by downloading our “How to Manage Debt” guide right now.

Learn more:

5 Best Apps to Effortlessly Save for Retirement(Freedom Debt Relief)

60% of Americans Aren’t Saving Enough for Retirement (Freedom Debt Relief)

Unemployed? Here’s How to Keep Managing Your Credit Card Debt (Freedom Debt Relief)

Many Older Workers Would Prefer to Ease into Retirement (SHRM)

Debt relief stats and trends

We looked at a sample of data from Freedom Debt Relief of people seeking a debt relief program during June 2025. The data uncovers various trends and statistics about people seeking debt help.

Credit card balances by age group for those seeking debt relief

How do credit card balances vary across different age groups? In June 2025, people seeking debt relief showed the following trends in their open credit card tradelines and average credit card balances:

Ages 18-25: Average balance of $9,117 with a monthly payment of $276

Ages 26-35: Average balance of $12,438 with a monthly payment of $380

Ages 36-50: Average balance of $15,436 with a monthly payment of $431

Ages 51-65: Average balance of $16,159 with a monthly payment of $535

Ages 65+: Average balance of $16,546 with a monthly payment of $500

These figures show that credit card debt can affect anyone, regardless of age. Managing credit card debt can be challenging, whether you're just starting out or nearing retirement.

Home-secured debt – average debt by selected states

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) (using 2022 data) the average home-secured debt for those with a balance was $212,498. The percentage of families with mortgage debt was 42%.

In June 2025, 25% of the debt relief seekers had a mortgage. The average mortgage debt was $236504, and the average monthly payment was $1882.

Here is a quick look at the top five states by average mortgage balance.

| State | % with a mortgage balance | Average mortgage balance | Average monthly payment | |

|---|---|---|---|---|

| California | 20 | $391,113 | $2,710 | |

| District of Columbia | 17 | $339,911 | $2,330 | |

| Utah | 31 | $316,936 | $2,094 | |

| Nevada | 25 | $306,258 | $2,082 | |

| Massachusetts | 28 | $297,524 | $2,290 |

The statistics are based on all debt relief seekers with a mortgage loan balance over $0.

Housing is an important part of a household's expenses. Remember to consider all your debts when looking for a way to get debt relief.

Manage Your Finances Better

Understanding your debt situation is crucial. It could be high credit use, many tradelines, or a low FICO score. The right debt relief can help you manage your money. Begin your journey to financial stability by taking the first step.

Show source

Author Information

Written by

Justine Nelson

Justine Nelson is the founder of Debt Free Millennials, an online community to help millennials eliminate debt and live a debt free lifestyle. As a freelance writer and YouTuber, Justine enjoys creating upbeat and educational personal finance content. This Midwest millennial paid off $35k in student loan debt and now resides in San Diego with her husband.