If You Have Lost Medical Insurance, You’re Not Alone

UpdatedJun 19, 2025

- One in seven American adults lost health insurance during COVID.

- You may be able to get coverage under COBRA or expanded Medicaid.

- Get coverage under the Affordable Care Act (ACA). health insurance is subsidized or free for those who meet income eligibility threasholds.

Table of Contents

In the midst of the coronavirus pandemic, more than one in seven adults became uninsured. So if you lost your medical insurance, you’re not alone. What should you do if you lose your workplace medical insurance? Is there help available for unemployed people with no medical insurance? And how can you protect yourself from medical debt when you’re unemployed?

Even as unemployment numbers fall, it’s not necessarily easy to find a job providing good medical coverage for you and your family. If you are an unemployed or uninsured American, you are probably concerned about your exposure to catastrophic healthcare costs.

Let’s take a look at what we know about uninsured Americans and how you might find and afford health insurance.

Uninsured workers by state

Workers who live in California, Texas, Florida, New York and North Carolina have been impacted the hardest, with a combined 46% of the uninsured increases. Most of the newly uninsured live in 10 states, accounting for 63% of those without medical insurance.

| State | Number Becoming Uninsured Between February and May 2020 |

|---|---|

| California | 689,000 |

| Texas | 659,000 |

| Florida | 607,000 |

| New York | 298,000 |

| North Carolina | 238,000 |

| Michigan | 222,000 |

| Illinois | 186,000 |

| Georgia | 178,000 |

| Massachusetts | 159,000 |

| Ohio | 139,000 |

Source: National Center for Coverage Innovation at Families USA

As the numbers continue to increase, many people are left to figure out how to obtain health coverage on their own. Between cumbersome state and federal systems, it can be frustrating to try and understand what you need to do to get covered. To make matters worse, as of now, no federal COVID-19 legislation that’s been signed into law includes comprehensive health insurance.

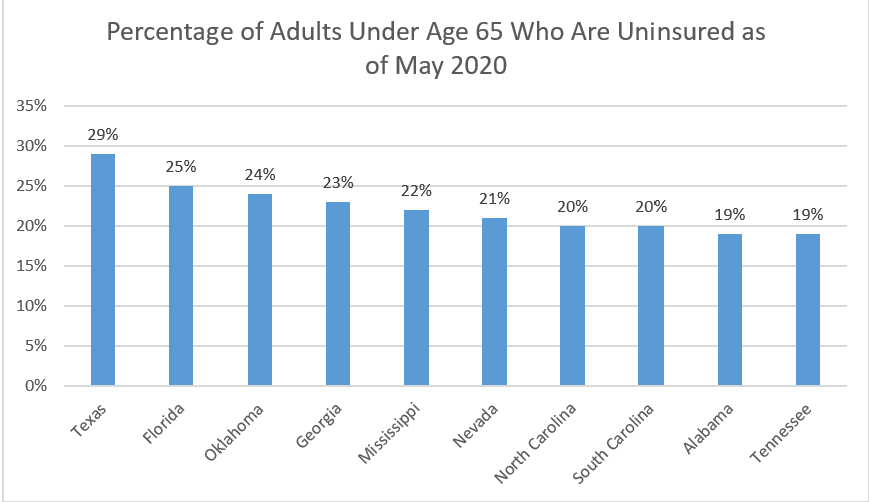

States with the highest percentage of uninsured adults

Of the top 10 states that hold the highest percentage of adults who have lost health insurance, half of the states are located in the south. Not surprisingly, many of these states had high unemployment rates during the same time period. Texas experienced a 13% unemployment rate in May 2020 while Nevada skyrocketed to a 25.3% unemployment rate.

Source: National Center for Coverage Innovation at Families USA

Jobless Americans still need healthcare coverage and with the number of uninsured Americans climbing, now is the time to understand your options to get covered again.

If you’re unemployed how do you get medical insurance?

You may know that programs like COBRA, Medicaid, and the Affordable Care Act marketplace are great options to find insurance once you become unemployed, but here is some more information you should be aware of as you work to get your family covered again.

If you were furloughed, not laid off

First, there may be a possibility you can still receive insurance from your employer. If you were furloughed and not laid off it might mean you still have coverage. A layoff means you are terminated either temporarily or permanently, whereas a furlough means you take temporary unpaid leave from work.

As a furloughed employee, you should also ask your employer how they are handling your health insurance premiums. Since you aren’t getting a paycheck right now, you probably won’t be paying your full share of health insurance, but you might have to pay those premiums back once you return to work.

Are you in a Medicaid expansion state?

Medicaid, the health insurance program provided to low-income Americans no matter their age, works differently state by state. For all states, you can qualify for Medicaid based on factors like income, disability, household size, and family status. In states that have expanded Medicaid coverage, you can qualify based on income alone.

Keep in mind, the CARES Act allows non-expansion states to cover COVID-19 related services for uninsured adults. Even if you live in a state that has not adopted the expansion, you can still receive coronavirus testing and avoid added medical debt as an uninsured adult. Here is a full list of states, showing which have and have not adopted the Medicaid expansion.

| State | Medicaid Expansion Status |

|---|---|

| Alabama | Not adopted |

| Alaska | Adopted |

| Arizona | Adopted |

| Arkansas | Adopted |

| California | Adopted |

| Colorado | Adopted |

| Connecticut | Adopted |

| Delaware | Adopted |

| Florida | Not adopted |

| Georgia | Not adopted |

| Hawaii | Adopted |

| Idaho | Adopted |

| Illinois | Adopted |

| Indiana | Adopted |

| Iowa | Adopted |

| Kansas | Not adopted |

| Kentucky | Adopted |

| Louisiana | Adopted |

| Maine | Adopted |

| Maryland | Adopted |

| Massachusetts | Adopted |

| Michigan | Adopted |

| Minnesota | Adopted |

| Mississippi | Not adopted |

| Missouri | Not adopted |

| Montana | Adopted |

| Nebraska | Adopted, not implemented |

| Nevada | Adopted |

| New Hampshire | Adopted |

| New Jersey | Adopted |

| New Mexico | Adopted |

| New York | Adopted |

| North Carolina | Not adopted |

| North Dakota | Adopted |

| Ohio | Adopted |

| Oklahoma | Adopted, not implemented |

| Oregon | Adopted |

| Pennsylvania | Adopted |

| Rhode Island | Adopted |

| South Carolina | Not adopted |

| South Dakota | Not adopted |

| Tennessee | Not adopted |

| Texas | Not adopted |

| Utah | Adopted |

| Vermont | Adopted |

| Virginia | Adopted |

| Washington | Adopted |

| Washington D.C. | Adopted |

| West Virginia | Adopted |

| Wisconsin | Not adopted |

| Wyoming | Not adopted |

Source: Kaiser Family Foundation

Use a healthcare navigator

If you aren’t furloughed or want to use something else than Medicaid, you can shop for your own health insurance. Even though navigating the health insurance system can be daunting, you can actually get a little advice in figuring out how to enroll by enlisting the help of a healthcare navigator.

A healthcare navigator helps you understand the healthcare system, including different types of insurance plans, benefits, and healthcare policies through the Affordable Care Act marketplace at HealthCare.gov. Typically, healthcare navigators are experienced healthcare experts who can help you understand different plans and which ones you could benefit from the most. Usually, their services are free for consumers. Once you are in the system as a patient, a navigator can also help you understand payments and billing.

Will I owe more on my taxes if I don’t have health insurance?

In years past, if you could afford health insurance but opted out of purchasing it, you may have paid a Shared Responsibility Payment when you filed your federal taxes. For the 2019 plan year and beyond, the Shared Responsibility Payment no longer applies at the federal level.

This is good news; however, each state has their own set of rules and some still have a health insurance mandate in place. The mandate could require you to have health insurance or pay a fee on your state taxes if you aren’t covered. These states have individual mandates:

Massachusetts

New Jersey

California

Vermont

Rhode Island

District of Columbia

Don’t overlook your financial health

If you’re dealing with an unexpected event like unemployment or lost medical insurance, you don’t have to go through it alone. The Freedom Debt Relief How to Manage Debt guide will walk you through your options on how to manage all types of debt, including medical debt. Start finding a solution by downloading the free guide right now.

Learn more:

Who Really Pays for COBRA? (Freedom Debt Relief)

Medical Bill Debt Relief Options (Freedom Debt Relief)

You Built an Emergency Fund During Lockdown. Time to Spend It? (Freedom Debt Relief)

4 Million Americans Have Lost Their Health Insurance. What to do if You’re One of Them (CNBC)

Insights into debt relief demographics

We looked at a sample of data from Freedom Debt Relief of people seeking debt relief during May 2025. The data provides insights about key characteristics of debt relief seekers.

FICO scores and enrolled debt

Curious about the credit scores of those in debt relief? In May 2025, the average FICO score for people enrolling in a debt settlement program was 593, with an average enrolled debt of $26,333. For different age groups, the FICO scores varied. For instance, those aged 51-65 had an average FICO score of 589 and an enrolled debt of $28,538. The 18-25 age group had an average FICO score of 548 and an enrolled debt of $15,062. No matter your age or debt level, it's reassuring to know you're not alone. Taking the step to seek help can lead you towards a brighter financial future.

Home-secured debt – average debt by selected states

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) (using 2022 data) the average home-secured debt for those with a balance was $212,498. The percentage of families with mortgage debt was 42%.

In May 2025, 25% of the debt relief seekers had a mortgage. The average mortgage debt was $236504, and the average monthly payment was $1882.

Here is a quick look at the top five states by average mortgage balance.

| State | % with a mortgage balance | Average mortgage balance | Average monthly payment | |

|---|---|---|---|---|

| California | 20 | $391,113 | $2,710 | |

| District of Columbia | 17 | $339,911 | $2,330 | |

| Utah | 31 | $316,936 | $2,094 | |

| Nevada | 25 | $306,258 | $2,082 | |

| Massachusetts | 28 | $297,524 | $2,290 |

The statistics are based on all debt relief seekers with a mortgage loan balance over $0.

Housing is an important part of a household's expenses. Remember to consider all your debts when looking for a way to get debt relief.

Support for a Brighter Future

No matter your age, FICO score, or debt level, seeking debt relief can provide the support you need. Take control of your financial future by taking the first step today.

Show source

Author Information

Written by

Justine Nelson

Justine Nelson is the founder of Debt Free Millennials, an online community to help millennials eliminate debt and live a debt free lifestyle. As a freelance writer and YouTuber, Justine enjoys creating upbeat and educational personal finance content. This Midwest millennial paid off $35k in student loan debt and now resides in San Diego with her husband.