What Is Budget Billing? A Guide to How It Works

- Budget billing is an option many utilities offer to help you pay the same amount each month.

- Budget billing protects you from sudden jumps in your utility bill, making budgeting easier.

- You make a fixed payment quarterly or year-round, paying more than you would in low-usage months, and less than you would in high-usage months.

Table of Contents

- What Is Budget Billing?

- How Does Budget Billing Work?

- Budget Billing Example

- Fees Associated with Budget Billing

- Advantages of Budget Billing

- What to Consider Before Enrolling in Budget Billing

- What Happens if You Use More Energy than Planned?

- Disadvantages of Budget Billing

- Comparing Budget Billing Pros and Cons

- Other Ways to Save Money on Utilities

- Budget Billing Alternatives

- Questions to Ask Your Utility Provider

- Is Budget Billing Worth It?

Have you noticed wild swings in your utility bills lately? Natural disasters or working from home can make costs unpredictable, wreaking havoc on your bills, and sometimes leading to a situation that calls for debt relief.

Many utility providers offer budget billing, which could help make your utility payments more predictable and affordable. Budget billing lets you pay a steady amount, avoiding sudden bill jumps. It’s handy for tight budgets, helping to prevent overdraft fees and surprises. Let’s take a closer look at how it works.

What Is Budget Billing?

Budget billing is a program utility companies offer that lets you pay a set amount each month for services like electricity, gas, or water. It’s designed to smooth out the spikes in your gas or electric bill, which could help you budget for it more easily throughout the year.

With budget billing, you avoid the steep ups and downs of seasonal use. Instead of paying more during peak times (like summer or winter) and less during lower-usage months, every monthly bill is the same amount, no matter how much or how little you use your utilities. Some utility companies adjust the payment amount quarterly.

How Does Budget Billing Work?

Budget billing works by averaging out your utility use over a set period, usually 12 months, to determine average monthly cost. Your provider tweaks the average for inflation or rate changes.

Several major providers like PG&E, Duke Energy, and Dominion Energy offer this program.

Eligibility for budget billing programs

You usually need a good track record with payments to sign up for budget billing.

PG&E: Requires a strong history of paying on time and in full

Duke Energy: Must have 12 months of billing history and no past-due balance

Dominion Energy: Requires at least 12 months at your current address with no unpaid bills

How much you pay

Once you’ve paid for a year of utilities, your provider averages your payments to set your monthly payment.

Changes in payments

When you use more or less energy than usual, your provider will adjust the average and update your bill. Depending on your provider, adjustments might be made monthly or quarterly.

New homeowners

New homeowners or renters may be charged based on the energy spending of previous occupants, or the utility’s general average for that property type. You may need a history of on-time bill payments to enroll—check with your provider.

Rate update communications

Your provider will usually update you when your monthly rate changes. You’re likely to receive a letter or email well before the change.

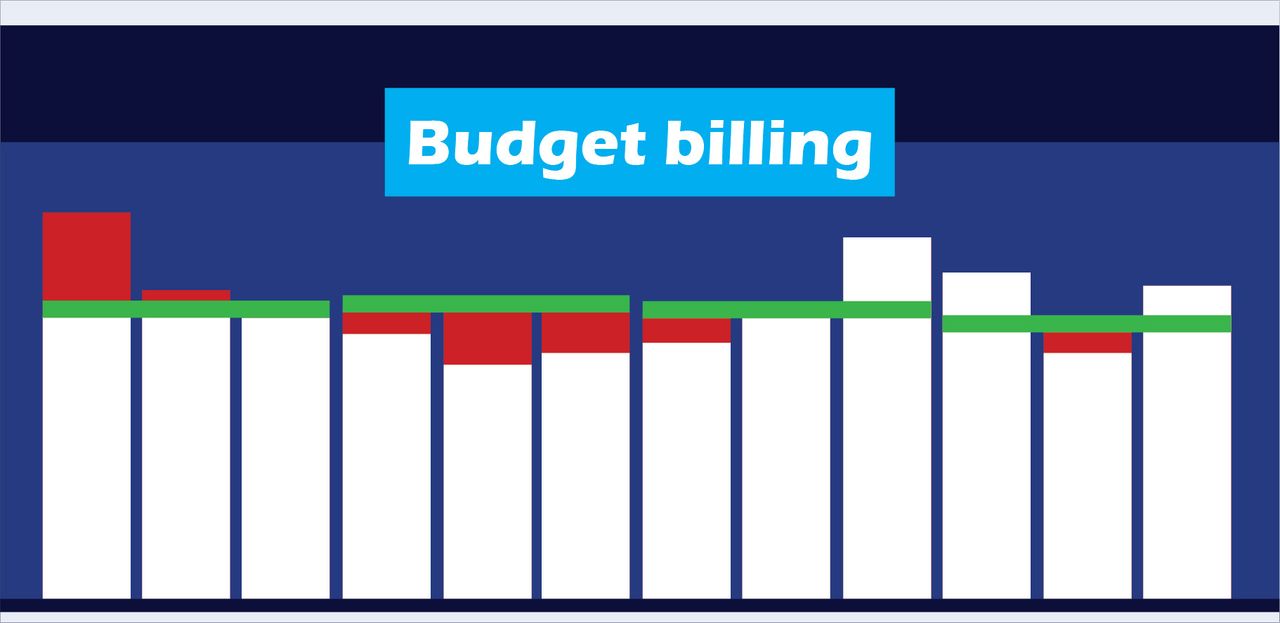

Budget Billing Example

Here’s what it looks like to enroll in budget billing.

1. Your utility calculates average usage

Say you paid $1,800 in energy bills last year. Your utility takes the monthly average to determine your payment. ($1,800 / 12 = 150) You start by paying $150 per month.

2. You make consistent monthly payments

For the next year, regardless of how much electricity you use, your monthly payment is $150.

| Month | Actual Usage Cost | Budget Billing Payment |

|---|---|---|

| September | $120 | $150 |

| October | $110 | $150 |

| November | $130 | $150 |

| December | $180 | $150 |

| January | $220 | $150 |

| February | $190 | $150 |

| March | $140 | $150 |

| April | $100 | $150 |

| May | $120 | $150 |

| June | $200 | $150 |

| July | $240 | $150 |

| August | $260 | $150 |

3. Your utility reviews your rate

After a period of time—in this example, one year—your provider reviews your payments. It looks at your actual electricity usage and costs vs. your budget billing payments.

Actual costs: $120 + $110 + $130 + $180 + $220 + $190 + $140 + $100 + $120 + $200 + $240 + $260 = $2,010

Total budget billing payments (past 12 months): $150 x 12 = $1,800

4. Your utility reconciles costs and adjusts your new payment

Your utility provider calculates the difference between what you spent and what you paid.

$2,010 − $1,800 = $210 (underpaid)

Since you spent more than you paid in utility bills, you have an outstanding balance of $210. Your provider might ask you to cover this as a lump sum (true-up), or offer to roll it over into next year’s payments, slightly increasing the monthly amount.

At the same time, your utility calculates your new monthly payment based on prior 12-month electricity spend ($2,010). $2,010 ÷ 12 = approx. $167.50

Additional per month from rollover: $210 ÷ 12 = approx. $17.50

New monthly payment: $167.50 (new average) + $17.50 (roll over) = $185

Your utility would inform you that your new payment is $185, starting next month, to account for greater electricity use and previous underpayment.

For simplicity’s sake, the example here assumes an annual review. But some providers review and adjust your rate monthly or quarterly. In such a case, your rate might fluctuate slightly, and your provider would try to keep changes to a minimum.

Fees Associated with Budget Billing

You might think budget billing comes with monthly fees, but many major utilities like PG&E, Duke Energy, and Dominion Energy offer it for no cost. Certain providers may charge small sign-up or monthly administrative fees, so double-check with your utility to avoid surprises.

Advantages of Budget Billing

Budget billing can be helpful in managing your money, with several perks:

Predictable payments. You pay the same amount every month, making budgeting easier.

No bill jumps. Avoid high bills during peak times.

Financial stability. Keeps you safe from overdraft fees or late charges from unpredictable bills.

What to Consider Before Enrolling in Budget Billing

Before enrolling in a budget billing program, consider these:

Check for fees. Make sure there are no extra costs to enroll with your provider.

Understand the refund policy. If you use less energy than planned, will you get a cash back refund or credit?

Review the contract. Look over the terms to get your rate, fees, refund policy, how long it lasts, and what happens if you move. Check to see if there’s a fee for leaving the program early.

Know the overuse rules. If you use more energy than expected, your rate may adjust, or you’ll owe a bigger bill later.

What Happens if You Use More Energy than Planned?

One possible downside of budget billing is using more energy than you thought. Your provider might impose:

Rate tweaks. Some, like PG&E, adjust your payment monthly to avoid big spikes.

Year-end bill. Others charge any extra at the end of the year, which could hit your wallet hard if you’re not ready.

Ask your provider how they handle this to stay ready.

Disadvantages of Budget Billing

Budget billing has a few downsides:

Fees. Some programs have ongoing administrative and start-up fees.

Higher electricity usage. You might use more electricity overall because you don’t realize how much you’re spending monthly.

Strict payment policies. Utility providers may be less tolerant of late payments on a budget billing plan compared to a standard plan.

End-of-year catch-up bill. Budget billing may not always line up exactly with your actual usage. That could mean an unexpected lump-sum bill at the end of the year if your usage exceeds the budgeted amount.

Comparing Budget Billing Pros and Cons

Stability and clarity are the number-one reasons to opt-into budget billing. On the other hand, it could lead to issues if your energy needs are difficult to estimate accurately.

Pros:

It feels stable. Knowing how much you’ll pay monthly brings peace of mind.

Budgeting is easier. It’s easier to budget when your monthly spend is predictable.

You avoid bill shock. Budget billing smooths over spikes and dips in energy use.

Cons:

Troublesome if your energy needs swing wildly. If you underpay or overpay big time, it could lead to issues. More on these below.

You might spend more energy overall. The disconnection between price and energy use makes it psychologically easier to spend more.

Who should avoid budget billing

Avoid budget billing if you prefer paying exactly what you owe each month. Budget billing can create a disconnect between price and energy usage by flattening out spikes and charging you the same each month. . You will need to do a little more legwork to see your actual usage, either by reading your paper bill in detail or logging into your online account to view it.

People whose yearly energy needs are highly unpredictable may also want to avoid budget billing. Underpayments could lead to a true-up, when you pay your utility a lump sum to cover the difference between what you paid for and how much energy you used. Overpayments could lead to lock-in; the utility will probably give you energy credits instead of cash back.

Other Ways to Save Money on Utilities

If after reviewing the pros and cons, you determine that budget billing isn’t for you, there are other ways to lower your utility costs. Here are several suggestions.

Switch to LED lightbulbs

LEDs use 70%-90% less power and last longer than regular bulbs. They’re more expensive, but in the long run the savings exceed the upfront cost. You can find LED light bulbs online or at local hardware or home improvement stores.

Install a programmable thermostat

Believe it or not, you could save up to 10% every year on heating and cooling costs. With a programmable thermostat, you’ll be able to set the temperature based on your schedule. If you leave home, you can easily turn it down or up a few degrees. Just turning your thermostat back 7º-10º F for eight hours a day from its typical setting could make a noticeable difference on your bill.

Change air filters

Change your HVAC filters regularly. If they become clogged with dust, dirt, pet hair, or other substances, your unit will have to work harder, and that increases your bill. Try changing your filters every few months.

Unplug devices

If you look around your home, there are probably appliances and devices that are plugged in even though you’re not currently using them. By simply unplugging your microwave, coffee maker, laptop, and hair dryer, you may be able to slash your utility bill by a few hundred dollars per year.

Budget Billing Alternatives

If traditional budget billing sounds like it won’t meet your needs, you have options. You can DIY budget billing, use a provider that does monthly rollovers, or try a different billing strategy.

DIY budget billing

Do it yourself. Calculate your average energy spend based on last year (last year’s total spend / 12). At the beginning of each month, transfer this amount to a savings account specifically for utilities. Use that money to pay your bills. You’ll earn interest without risk of lock-in or losing track of how much energy you’re consuming. To make this even easier, automate monthly transfers from your checking to your savings.

The downside of DIY budgeting billing is you have to manually move money around. When you spend a lot during a high-energy month, you must pay the bill in full. You must pay in full even when you haven’t set aside enough money in your savings account.

Use a provider that does monthly rollovers

Choose a provider that calculates your bill on a 12-month rolling average. Each month, your bill is updated to reflect the average of the last 12 months. This keeps your payments smooth and responsive to major changes in your energy spending

Flat fee plans

Subscribe to flat monthly payments. Your payments are super-consistent—no matter how much you spend, your subscription remains flat. However, these plans usually come with usage caps or penalties for spending a lot more than the agreed-upon amount.

EV-specific pricing

Own an electric vehicle (EV)? Choose a provider that offers plans specifically for people like you. These plans might offer lower rates during off-hours, like at night, so you can charge your vehicle without racking up big bills. Providers can do this because grid demand is lower at certain times of day. EV owners are uniquely suited to take advantage of weird hours.

Questions to Ask Your Utility Provider

Ask your provider the following questions to avoid being taken by surprise.

Are there start-up or maintenance fees?

Some providers charge these. You may prefer to partner with a utility that offers budget billing at no extra cost. Most large utilities don’t charge start-up or maintenance fees.

How is the monthly amount calculated and updated?

Utilities typically calculate the initial payment based on the average of last year’s spending. This amount is updated monthly, quarterly, or yearly to reflect recent payments.

What happens if you overpay or underpay?

Overpayments lead to a refund or credit toward your next bill. Underpayment results in a lump sum payment during monthly/quarterly/yearly review, or is rolled over into later payments.

What happens when you move or end service?

Your final bill will settle. You’ll be charged for unpaid bills and credited for overpayments.

Are there early termination policies?

Some plans might penalize you for canceling early. Check with your provider for details.

What are the contract terms and conditions?

Check details like whether you’re eligible, when payments are due, and how disagreements between you and your provider are handled.

Is Budget Billing Worth It?

Some people will benefit more than others.

| Who benefits most | When it might not be the best choice |

|---|---|

| Fixed-income households (retirees, social security recipients) | Households with changing usage patterns (new appliances, moving, more/fewer residents) |

| Families needing predictable cash flow | Those motivated by usage-based bills to conserve energy |

| People who struggle with seasonal spikes in heating/cooling bills | People uncomfortable with utilities holding their overpayments |

People just like you are seeking debt relief in Phoenix, AZ and across the country. The first step is the most important one—explore your options.

Debt relief stats and trends

We looked at a sample of data from Freedom Debt Relief of people seeking a debt relief program during January 2026. The data uncovers various trends and statistics about people seeking debt help.

FICO scores and enrolled debt

Curious about the credit scores of those in debt relief? In January 2026, the average FICO score for people enrolling in a debt settlement program was 593, with an average enrolled debt of $25,843. For different age groups, the FICO scores varied. For instance, those aged 51-65 had an average FICO score of 588 and an enrolled debt of $27,829. The 18-25 age group had an average FICO score of 556 and an enrolled debt of $17,051. No matter your age or debt level, it's reassuring to know you're not alone. Taking the step to seek help can lead you towards a brighter financial future.

Student loan debt – average debt by selected states.

According to the 2023 Federal Reserve Survey of Consumer Finances (SCF) the average student debt for those with a balance was $46,980. The percentage of families with student debt was 22%. (Note: It used 2022 data).

Student loan debt among those seeking debt relief is prevalent. In January 2026, 27% of the debt relief seekers had student debt. The average student debt balance (for those with student debt) was $48,703.

Here is a quick look at the top five states by average student debt balance.

| State | Percent with student loans | Average Balance for those with student loans | Average monthly payment |

|---|---|---|---|

| District of Columbia | 34 | $71,987 | $203 |

| Georgia | 29 | $59,907 | $183 |

| Mississippi | 28 | $55,347 | $145 |

| Alaska | 22 | $54,555 | $104 |

| Maryland | 31 | $54,495 | $142 |

The statistics are based on all debt relief seekers with a student loan balance over $0.

Student debt is an important part of many households' financial picture. When you examine your finances, consider your total debt and your monthly payments.

Manage Your Finances Better

Understanding your debt situation is crucial. It could be high credit use, many tradelines, or a low FICO score. The right debt relief can help you manage your money. Begin your journey to financial stability by taking the first step.

Show source

Author Information

Written by

Cole Tretheway

Cole is a freelance writer. He’s written hundreds of useful articles on money for personal finance publications like The Motley Fool Money. He breaks down complicated topics, like how credit cards work and which brokerage apps are the best, so that they’re easy to understand.

Reviewed by

Kimberly Rotter

Kimberly Rotter is a financial counselor and consumer credit expert who helps people with average or low incomes discover how to create wealth and opportunities. She’s a veteran writer and editor who has spent more than 30 years creating thousands of hours of educational content in every possible format.

What is budget billing?

Budget billing is a program through your utility company that lets you pay the same amount every month for electricity or gas. Some people find it easier to manage their money this way, instead of having bills that go up and down with your usage.

Will budget billing save me money?

No, budget billing doesn’t lower your total costs—it just spreads them out evenly. You might use more energy if you’re not careful. Since the bill stays the same, you might feel more relaxed about usage. Typically, budget billing helps you avoid unwelcome high bills.

Can I quit budget billing if I don’t like it?

Yes, most utilities let you stop anytime. Your account will need to be reconciled to reflect your actual usage. Then, you’ll either receive a refund if you paid more than you actually used. If you have an outstanding balance, it will need to be paid according to your bill’s due date. Check with your provider for details of their specific program.

How do I sign up for budget billing?

Contact your utility provider via phone or website. You may be able to enroll yourself in the program online. Check eligibility requirements before putting in too much effort. You may need a history of timely bill payments to enroll.

Can I use budget billing with renewable energy providers?

Yes, in many cases. Renewable energy companies and green power programs often offer budget billing like traditional utilities. Availability depends on the provider and your local regulations, so check with your energy company to confirm.

What happens to my budget billing if I switch providers?

When you switch, your current utility will close out your budget billing plan with a final reconciliation (a true-up). If you’ve paid more than your actual usage, you’ll receive a credit or refund. If you’ve underpaid, you’ll owe the balance. Budget billing doesn’t carry over, so you’ll need to enroll with your new provider if they offer the option.

Does budget billing affect my credit score?

No, budget billing itself has no impact on your credit. It just changes how your payments are structured. Your credit score is only affected if you miss payments or an unpaid balance goes to collections. Paying on time keeps your credit safe.