Debt Solutions

- Debt solutions are widely available for consumers with too much credit card debt.

- Less-drastic tactics include debt consolidation and debt management.

- Debt settlement and bankruptcy are solutions for more serious debt problems.

As we move past the worst of the COVID pandemic, credit card debt is back -- with a vengeance.

Total credit card debt has recently risen to record levels.

On top of that, the combination of inflation, a slowing economy, and rising interest rates is creating a perfect storm.

Under the circumstances, it's no wonder you might need some help with your financial situation. There are several possible solutions if your credit card debt is increasing and your monthly payments are getting harder to meet.

This article covers debt problems and fixes.

Topics include:

The cost of credit card debt

Your financial situation

Possible debt solutions

Debt consolidation

Debt management plan

Debt settlement

Bankruptcy

The longer you delay taking action, the worse your financial problems may get. It’s time to find the right solution for your situation.

The Cost of Credit Card Debt

Two recent trends paint a picture of what's going on with credit card debt:

Total debt is rising

Interest rates are rising

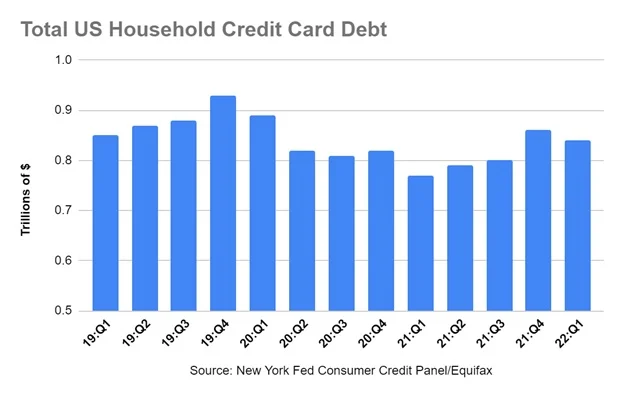

Here's the total amount of credit card debt outstanding over the past two years, according to the Federal Reserve:

After declining somewhat in 2020, total credit card debt rose last year. This trend continued in 2022, bringing total debt to just over $1.1 trillion – a new record.

This additional debt is getting even more expensive because interest rates are rising.

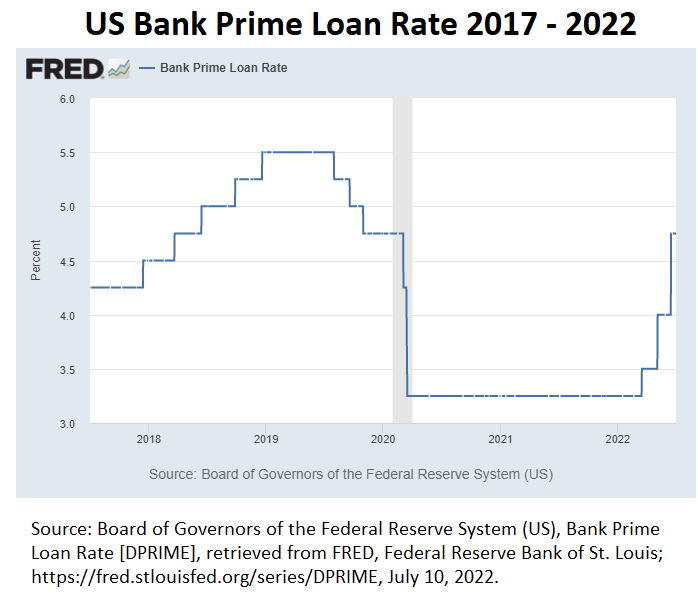

Credit card rates are based partly on the bank prime rate, which moves with the Federal Funds rate. The bank prime rate has risen sharply this year by 1.5%:

Economists expect more rate increases this year due to surging inflation.

These charts show what consumers are up against these days: rising credit card debt and interest rates. You may feel helpless facing those challenges, but you can meet them.

How’s Your Financial Situation?

Can you ride out the rising tide of inflation? Here are some signs you need to improve your financial management:

Your credit card balances are rising.

You've maxed out the credit limits on some or all of your cards.

Your credit score is declining.

You can rarely afford to make more than minimum monthly payments.

You've been late with one or more payments in the past year.

You’ve incurred late charges.

You have to cut necessities like food and healthcare.

If one or more of the above describes your situation, don't expect things to magically get better. You need to take action to change things.

Possible Debt Solutions

The following table lists debt solutions from least to most drastic. So, start at the top and work your way down till you find one that meets your needs.

| Type of solution: | Good if you: |

|---|---|

| Debt consolidation | Want to simplify your payments Can pay your debts, but would like to reduce the cost Have a lot of high-interest, unsecured debt |

| Debt management | Need help organizing your payments Would like to pay your debts, but are having trouble affording the payments Would like to reduce the interest rate on your debts Would like to lower the monthly payments on your debts |

| Debt settlement | Have more debt than you can afford Have tried debt consolidation and/or debt management but still can’t keep up with your payments Would like to reduce the total amount you owe Have substantial unsecured debts Accept that you may have difficulty getting credit for years afterward Understand the potential tax consequences |

| Bankruptcy | Have been unsuccessful at attempts to negotiate with creditors Have no other means of settling your debts Are willing to sacrifice some of your remaining assets or future income Accept that this will cause long-term damage to your credit record Can live with the process being in the public record |

The sections below describe these debt solutions in greater detail.

Debt Consolidation

Debt consolidation means combining two or more debts into a single account.

Debt consolidation offers a few advantages:

Replacing multiple accounts with one loan makes it easier to manage your payments.

Debt consolidation can help you pay less interest.

You may be able to replace variable interest rates with fixed interest rates.

Consolidating can make your payments more affordable by reducing your interest rate, giving you more time to pay, or both.

The best debts to consolidate are those with higher interest rates, because they provide greater opportunity to save money. These typically include credit card balances and unsecured loans.

Accounts like mortgages, auto loans and student loans typically have low interest rates and other features that make them less attractive targets for consolidation.

Debt consolidation works by using a new loan to pay off existing debts. The key is to choose a consolidation loan with favorable terms like lower interest rates and/or lower monthly payments.

Some good choices for consolidation loans include:

Personal loans, because their interest rates are fixed and tend to be lower than credit card rates

Home equity loans, which have some of the lowest rates available

Balance transfer cards, especially if you can pay off the balance before the zero-interest period expires

Debt Management Plan (DMP)

If you don’t qualify for a debt consolidation loan, a debt management plan might be right for you. Debt management plans are also a form of debt consolidation because you replace multiple payments with one.

Here’s how it works. You meet with a credit counselor, enrolls your unsecured debts into the plan. Your counselor contacts your creditors and asks them to reduce your interest rate, waive late fees, or lower your payment. Your counselor calculates a monthly payment to cover your accounts and your monthly plan fee.

You will probably have to close your accounts so that you don’t continue adding to your debt when you’re supposed to be paying it off.

Every month, you make one payment to the DMP and your counselor distributes it among your creditors. DMPs can be successful if the payment is affordable. They do not reduce what you owe but may speed up repayment and make it easier.

Debt Settlement

Debt settlement involves negotiating with creditors to accept less than you owe as payment in full. Here’s how the process usually works:

You enroll your unsecured debts with a debt settlement company.

You stop making payments to your unsecured creditors and instead pay as much as you can afford into a debt settlement savings account.

When you have saved a “respectable” amount to offer, your debt consultant contacts a creditor and negotiates a lower amount as payment in full.

Only if you agree to that amount, you transfer the funds, the creditor forgives the remaining balance, and you pay the debt settlement company its fee.

You’ll repeat this process until you address all of your enrolled debt. Understand that creditors don’t have to settle with you and that there is no guarantee that they will.

Why would lenders accept less than you owe? Because the alternative is a long, expensive collection process that might not succeed. If a creditor believes you can’t afford the full amount, it’s more likely to settle. Skipping payment for a few months does more than help you save a lump sum – it may demonstrate that you can’t afford the debt.

Debt settlement works best with unsecured debt. Secured creditors like mortgage or auto lenders can just take your house or car if you don’t repay them. They have little reason to settle for less than the entire loan balance.

Be advised that having debts written off looks very bad on your credit report. Also, the IRS may treat the amount written off as income, and then you’d owe taxes on it.

Bankruptcy

Bankruptcy is a formal legal process to settle your debts. It also protects you from continued collections efforts.

There are serious costs to bankruptcy. With a Chapter 7, you surrender assets to the court in exchange for discharging your debts. Chapter 7 is only available to those who cannot afford to repay even part of their debts.

Many filers have to file Chaper 13, which requires them to pay into a plan for three to five years. A judge sets the payment and it can be painfully high. At the end of the plan period, any remaining balances are forgiven, tax-free.

Bankruptcy stays on your credit report for seven or 10 years (depending on the type of bankruptcy). It’s difficult and expensive to get credit for a few years following a bankruptcy.

Finally, bankruptcies are public, so you won't be able to keep your money problems private. And you can’t get a job in certain fields if you have a bankruptcy on your record.

As you know, financial problems tend to get worse the longer you delay dealing with them. The sooner you get started, the sooner you'll put those problems behind you.

Will signing up for a debt management program affect my credit score?

Just signing up for the program shouldn't affect your credit score one way or another. If you’re required to close your accounts, your score will probably drop temporarily. But as you pay your debts off, you’ll be in a better financial position, and your score should improve.

If I consolidate debt, will I have to close my credit card accounts?

Not usually, although it can be a condition of your loan. Keeping accounts open can help your credit score because it improves the average age of accounts and your credit utilization. However, if you overspend and carry balances, it’s probably better for you to close the accounts and get some counseling. Debt consolidation failure usually happens when people run up their balances again and end up worse off than before.

How much total debt is too much?

This depends on your situation. Ideally, you should be using a low percentage of your available credit (under 30% at most). Also, your debt payments should not take up too much of your gross monthly income – no more than 43% – and of course, lower is better.