Guide to Credit Scores

- Your credit score measures how likely you are to repay your debts on time.

- You probably have many credit scores based on different formulas.

- Having a good credit score can save you a lot of money in your lifetime.

Table of Contents

What is a credit score? A credit score is a number assigned to you that represents your creditworthiness – the likelihood that you will pay your creditors as agreed or default (not pay) on your loans.

This article covers credit score topics, including:

How is your credit score determined?

How FICO calculates your credit score

How VantageScore calculates your credit score

What are credit score ranges?

What is a good credit score?

How to check your credit score for free

How to raise your credit score

Credit score FAQs

How Is Your Credit Score Determined?

It takes two things to make a credit score – a credit report and a credit scoring model.

You probably have three credit reports – one from each of the three largest credit reporting agencies (CRAs) – Experian, TransUnion, and Equifax. They collect information about you from lenders, collection agencies, court systems, and other sources and compile it into a report.

Note that a credit report does not contain a credit score. To get a credit score, a lender applies a credit scoring model to your credit report. The most commonly used credit scoring models are FICO and VantageScore, and there are many versions of those two models.

How FICO Calculates Your Credit Score

While the exact math of a credit scoring model is secret, FICO indicates that these five factors from your credit report make up your credit score:

35% Payment history (payments more than 30 days past due are considered late)

30% Amounts owed (amount of credit used compared to the amount available, also called "credit utilization")

15% Length of credit history

10% Credit mix (Having mortgages and installment loans in addition to credit cards is considered better than just having credit cards)

10% New credit (This refers to credit inquiries when you apply for a loan; each inquiry can drop your score by three to five points)

How VantageScore Calculates Your Credit Score

VantageScore does not list specific percentages but indicates factors in order of importance. They differ from FICO in that credit utilization, and mix/experience are more important than payment history:

Total credit usage, balance, and available credit: Extremely influential

Credit mix and experience: Highly influential

Payment history: Moderately influential

Age of credit history: Less influential

New accounts opened: Less influential

What Are Credit Score Ranges?

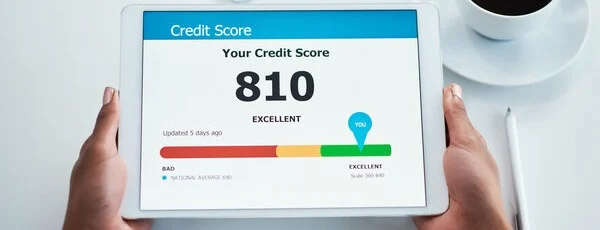

Credit scores range from 300 to 850, and higher scores are better than lower scores. The FICO and VantageScore have similar credit score ranges that divide consumers into groups.

FICO score ranges

The standard FICO score ranges from 300 to 850. FICO also offers industry-specific credit scoring models for credit card companies and auto lenders that range from 250 to 900. Here are the ranges for FICO:

300-579 Poor

580-669 Fair

670-739 Good

740-799 Very Good

800-850 Exceptional

The average FICO score in the US has risen steadily over the years; in 2022, it is 716. The table below shows FICO score trends since 2010.

VantageScore ranges

VantageScore ranges originally ranged from 501 to 990, which was confusing to consumers. The latest two models use the same range as FICO but group them a little differently:

300-499 Very poor

500-600 Poor

601-660 Fair

661-780 Good

781-850 Excellent

It's important to understand that creditors don't always use these tiers when making decisions.

What Is a Good Credit Score?

FICO defines a "good" credit score as 670 to 739, and VantageScore considers scores between 661 and 780 to be "good." However, creditors have their own tiers. If you apply for a mortgage, for instance, you'll be treated very differently if you have a 780 credit score than you will with a score of 661.

So, what's a good credit score for a mortgage? You can, in theory, get an FHA home loan with a credit score as low as 500. However, very few loans are approved with low scores because while the FHA allows FICO scores as low as 500, it does not allow recent bad credit history. Most lenders set their minimum acceptable credit score at 620 or higher, and many programs require FICO scores of 680, 720, or even 740.

What's a good credit score for a car loan? You can get a car loan pretty easily with a credit score of 660 or higher. However, your interest rate will be close to 8%. To qualify for the best auto loan rates, rebates, and other perks, you need a score closer to 760 than 660.

What's a good credit score for a credit card? If your score is 670 or higher, you'll qualify for many cards at average interest rates. To get the best cards, however, you'll need excellent credit, and if your score is 800 or higher, you can get approved for almost any credit card on the planet.

How to Check Your Credit Score for Free

You can get a free credit report at the federal government's site, www.annualcreditreport.com, once a year. Since you have three credit reports (from TransUnion, Experian, and Equifax), you could check each one every four months to keep tabs on your credit. You can also get a free credit report in certain circumstances, for example, if you are denied credit.

However, the government does not provide your credit scores. The good news is that free credit scores are widely available from many sources, including

Experian (FICO score), if you sign up for a free account

Equifax (FICO score), by signing up for a free account

Credit unions and banks (many offer free credit scores to their customers)

Many major credit card companies, including American Express, Bank of America, Citibank, Commerce Bank, and Discover

Personal finance sites like Credit Karma and Credit Sesame (VantageScore)

Understand that in exchange for free VantageScore numbers, you provide your personal information to these sites, which they use for marketing purposes. Most providers of free credit scores also offer credit monitoring services, and some of those are free. They also sell premium credit monitoring and identity theft prevention.

How to Increase Your Credit Score

The first step to improving your credit score is checking your credit report and getting a free credit score. Then, follow these steps:

Dispute inaccurate information on your credit report

Over one-third of credit reports in the US have incorrect information, and in many cases, those errors can cause you to pay more for credit or be denied altogether. Go through your report and ensure that the accounts listed are yours and that any derogatory entries are not errors.

You can dispute errors online or by mail with the bureaus. Provide documentation to back up your claim. If you paid a bill on time, upload your bill pay statement or canceled check. Remember that an account is not due until 30 days past due.

If you're applying for a mortgage, your lender can help you get rid of errors much faster with a "rapid rescoring" service. The fee is modest and can clear an error in a day or two, while the normal process can take 30 days.

Check your reason codes

FICO scores come with "reason codes," which disclose the factors causing your score to be lower than it could be. Here are the most common, according to Equifax:

Serious delinquency

Public record or collection filed

Time since delinquency is too recent or unknown

Level of delinquency on accounts is too high

Amount owed on accounts is too high

Ratio of balances to credit limits on revolving accounts is too high

Length of time accounts have been established is too short

Too many accounts with balances

Once you know why your credit score is low, you can do something about it.

Plan to raise credit score

Your next steps to raise your credit score depend on why your credit score is low. You'll be addressing one of these three issues:

Short or limited credit history

Bad credit history

Credit utilization is too high

If you have no credit or not much credit

If your issue is a short or limited credit history, you need to become more visible.

Become an authorized user on one or more accounts – ask friends or relatives with great credit.

Apply for a card for people with no credit history – many of those designed for students accept people like you. The interest rate might be high, but if you don't carry a balance, it won't matter.

Apply for a secured credit card – just make sure the fees are low and that it reports your good payment history to all three credit bureaus.

Apply for a small personal loan and pay it back promptly.

If you rent, look into a rent reporting service. Some are free, and others have a fee. All three credit bureaus will add rent to your credit report if they get it, and newer versions of FICO and VantageScore incorporate rent payments into your credit score.

In less than 12 months, you can go from "credit invisible" to "credit respectable." It takes time to build a perfect credit score, but if you use credit regularly but conservatively – and always pay on time – you'll get there.

If you have bad credit

Having bad credit is more of a challenge. People with bad credit history have a record of missing payments, paying late, or having charge-offs or collections. It takes time to get past bad credit history, but you can begin to improve your credit score right away.

First, set yourself up for success by putting your accounts on automatic payment. You can do this with credit cards, installment loans, and utilities. Stagger your payment dates so you don't get hit with all of them at once.

Add good tradelines to your credit report by using the same tactics as a person with no credit – authorized user accounts, secured or "second chance" credit cards. Get a small personal loan – with a co-signer if necessary – and pay it off.

If you owe too much

"Too many accounts," "Too many accounts with balances," and "Amounts owed are too high" are common reasons for low credit scores. Carrying balances from month to month is a sign of overspending, and that often ends badly – in bankruptcy or with charge-offs and collections.

So your first step is to stop over-spending. Get help from a credit counselor if you have trouble cutting back.

The next step is to address your credit utilization ratio. People with good credit scores have credit utilization ratios under 30%, and those with great credit keep it under 10%. You can calculate your credit utilization ratio by adding up all credit card limits. Then add up your current balances. Divide your balances by your limits. For instance, if you have credit lines totalling $3,000, and your balances equal $2,000, your credit utilization equals $2,000 / $3,000 = 67%. That's a rather high ratio.

How can you lower a credit utilization ratio? There are a few ways:

You can increase the amount of credit you have by requesting increases to credit lines or by applying for additional credit (and not using it). If you get another $3,000 credit line, your ratio would change to $2,000 / $6,000 = 33%.

You can replace unsecured debt, which counts in your utilization, with installment debt, which does not. So if you consolidate your $2,000 in credit card debt with a personal loan and stop carrying balances on your credit cards, your utilization drops to zero.

However, those are temporary fixes. Ultimately, you want to pay off your credit card debt and stop carrying balances. You can accelerate repayment with a debt snowball or debt avalanche plan or with a debt management plan (DMP) from a credit counseling agency.

Ultimately, improving your credit score will also increase your financial security. It's well worth doing.

What is the difference between a credit report and a credit score?

A credit report contains your credit information. That includes your credit limits, account balances, payment amounts, and payment history. It also shows inquiries (when you apply for credit and a lender pulls your credit report), public records like lawsuits or bankruptcies, and collection accounts. Your credit report also contains personal information like your date of birth, social security number, address, and employment information. This personal information is not a factor in credit scoring.

A credit score is a number calculated from the information contained in your credit report. The score makes it easier for lenders to make decisions. Instead of looking through your entire credit report, lenders can set minimum credit scores for eligible applicants.

Why are my credit reports different?

Your three credit reports will probably be slightly different. That’s because creditors might report to CRAs at different times, which can affect the account balance that they report. Also, some creditors only report to one or two CRAs, so each report is likely to show different accounts and balances.

How many credit scores are there?

You have many different credit scores because there are many scoring models, and each model can be applied to credit reports from the three credit reporting agencies.

The credit score that you get if you request a credit score is an “educational” score that lenders don’t use to make decisions. There are credit scoring models for different kinds of loans and for insurers and employers.

It makes sense, then, that you have many credit scores. FICO alone has 16 credit scores. VantageScore has four. If there are 20 versions of credit scoring models applied to three reports, that’s 60 different credit scores!

But wait; there’s more. FICO has come out with newer scoring models, including the FICO Score 10 Suite which includes a base FICO Score 10, a FICO Score 10 T (which includes trended data), and new industry-specific scores. And FICO is rolling out its UltraFICO Score, which lets you link checking, savings, or money market accounts and incorporates banking activity. Lenders even create custom credit scoring models.