America’s leader in debt resolution

As a leader in debt resolution, we help everyday people lift their debt burden to live the lives they want.

- 1 million+client served

- 4 million+accounts settled

- $18 billion+in debt resolved

Our story

Your bridge to a better financial future

Freedom Debt Relief started in 2002 after a recession impacted millions of people and left them with overwhelming debt. With a mission to bridge the gap in how major financial institutions serve everyday people, Freedom Debt Relief continues to provide debt solutions and education to resolve debt, build savings, and achieve financial freedom.

Our principles

What you can count on

Here’s how we resolve your debt using the principles we stand behind:

A human approach

No matter your situation, we’ll listen to you and treat you with respect, empathy, and understanding.

Moving you forward

When you meet a goal, we’re here to help with the next. Every day, we’ll work together to push your finances in a better direction.

Personalized solutions

We’ll work with you to customize a solution to resolve debt so that it fits your life today, and gets you where you want to be in the future.

Financially smarter

We’ll teach you how to manage your money with confidence and transform how you think about your financial future.

An established business with experts on your side

200+

experienced debt negotiators

500+

certified debt consultants

300+

customer service representatives

1,600+

employees across the country

Our recognition

Promoting financial health and advocacy

Freedom Debt Relief is a founding member of the AADR and a member of multiple organizations committed to protecting consumers from abusive practices.

American Association for Debt Resolution

The American Association for Debt Resolution (AADR) is dedicated to promoting and adhering to best practices in the debt resolution industry.

Better Business Bureau

The Better Business Bureau (BBB)’s mission is to focus on advancing marketplace trust. Freedom Debt Relief is accredited by the BBB with an A+ rating.

Financial Health Network

The Financial Health Network (FHN) unites industry, business leaders, policymakers, innovators, and visionaries committed to protecting consumers.

Learn more about Freedom Debt Relief

How it works

How Freedom Debt Relief works

Why our program

Why choose Freedom

Client stories

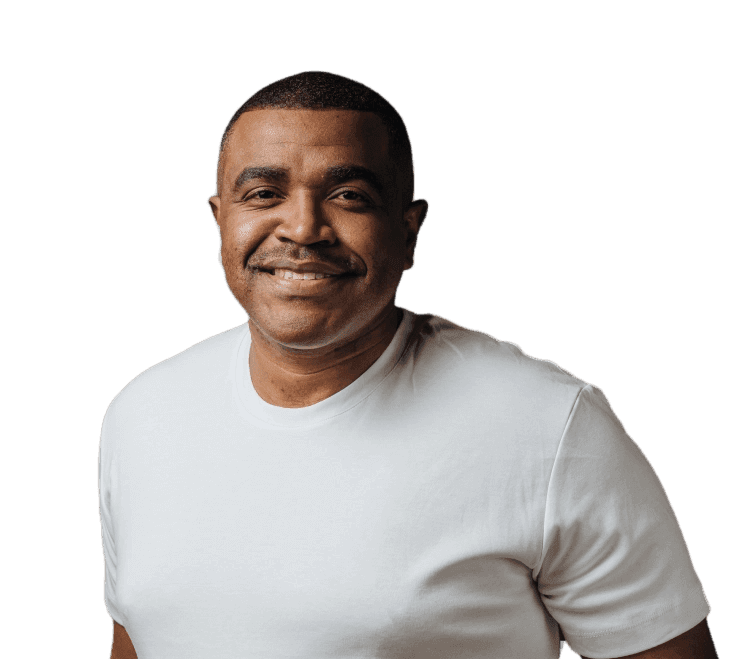

What our clients say about us

Make a difference in the lives of millions by joining our team

- People-first mentality

- Industry-leading success

- Remote-friendly positions